A sensational rally accelerates in continuation after Phantom broke the key resistance at $0.50. But will this continue and how high can FTM go?

After enduring a challenging period of crypto winter price consolidation in 2022, which saw Phantom Stuck in a range between $0.16 and $0.44 for 8 months, January brought a bright start.

Phantom bulls continued to drive the rally higher and higher, despite analysts’ predictions.

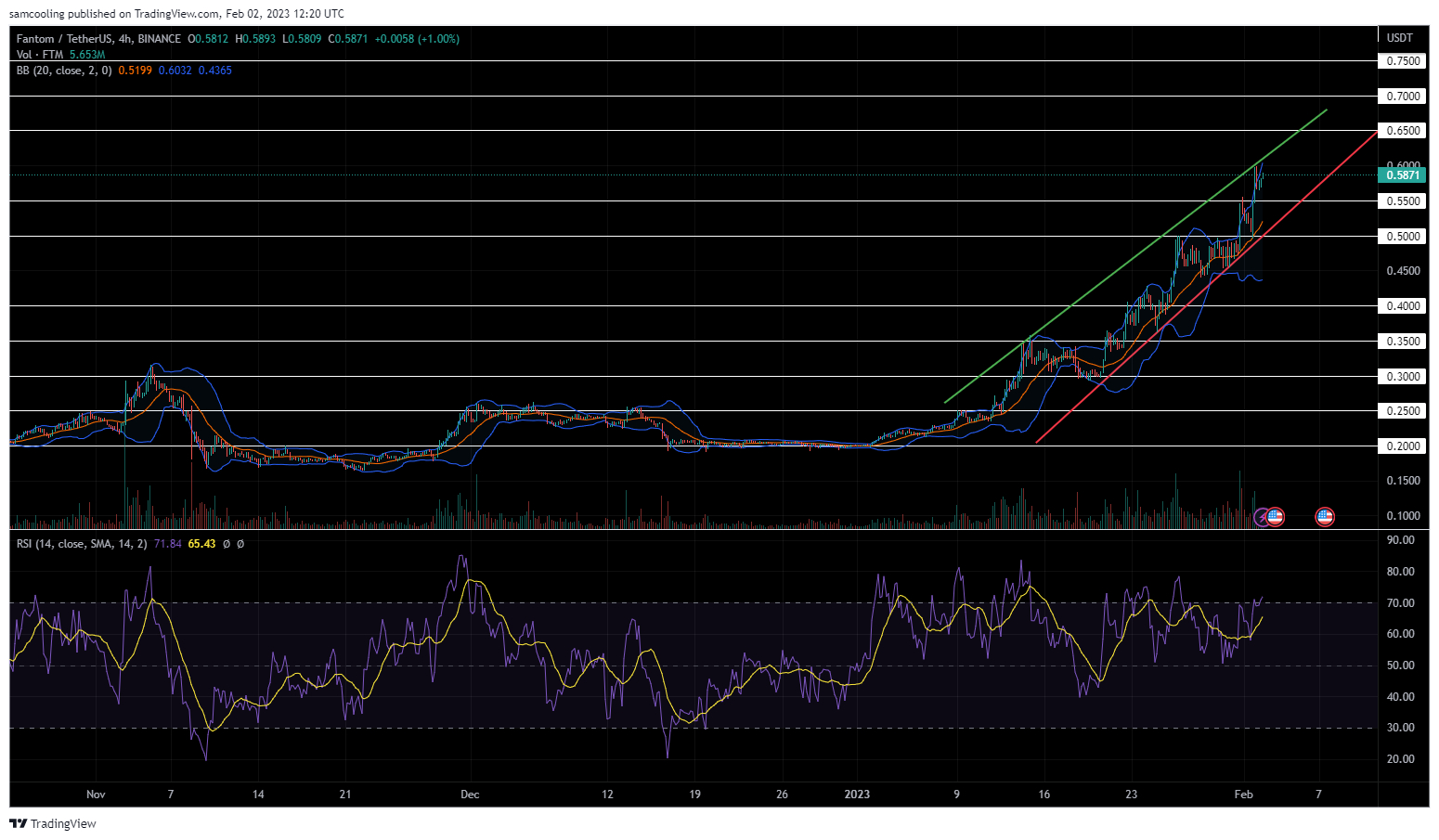

The tightening of the Bollinger Bands (volatility measure) on January 2 set the stage for a steady rally.

And then price levels broke across the floor, as a bull in a china shop phantom soared through past areas of support and resistance.

Buoyed by macro sentiment from bitcoin and the US economy. Bulls have gained 200% in the whole of January so far.

The bulls are holding their ground despite the struggle at $0.35 and $0.40. Finally, the key resistance at the end of January was broken at $0.50.

February now marks a decisive breakout, characterized by large bullish candles. FTM is in pure price exploration mode, currently trading at $0.60 (+4.92% 24hr).

How high can FTM go?

There seems to be a brief hesitation at the $0.60 psychological level. This is a level with little historical resistance, and a break out as price action heads for the upper trend line is likely.

With such a bullish and strong bullish channel forming, it can be predicted that the price will move on to test the next level.

$0.65 is a potential area of resistance to fight against (11% gains from here). A rally through this level is likely to see a local top at $0.75 (25% from here).

Looking at our indicators lights up more.

The RSI shows a strong rally. The bulls moved the price in 3 major moves that each came close to heating up this signal.

But confidence in the rally remains high. Despite the overbought signals, the RSI has cooled down during each flip of the support.

The RSI is currently sitting at 71. This in itself is a bearish signal. But when comparing the RSI highs at each major push of this rally (80+) – the buying pressure remains.

During bearish times, this signal could signal a local retracement. The price could move lower to test the rally support against the support level and lower trend lines. ftm Haven’t tested support for more than 24 hours.

Looking at the MACD, there is a strong bullish signal at 0.0057 – highlighting the stability and momentum of this rally.

Why is Phantom rallying?

The rally was a success story as the cryptocurrency market rallied throughout January. Driven by improving macro sentiment from the US Federal Reserve and Bitcoin.

But the Phantom 2023 itself has already gone through quite a transformation.

Andre Cronje has announced that Fantom will upgrade the struggling ecosystem to a native stablecoin.

The bullish sentiment surrounding the plans to launch the FUSD V2 undoubtedly plays a role. The upgraded stablecoin will remain mintable using FTM, opening the door for a growing range of DeFi offerings.

version 2 of fUSD There will also be a feature of auto-liquidation of positions where fUSD exceeds the FTM support. For example, if a trader does not have sufficient funds to maintain a leveraged position.

The rally also comes amid big moves in the Phantom ecosystem.

TVL has increased $567m locked (+36%) across January.

And the market cap has increased by 135% courtesy this phenomenal rally. Phantom’s market cap now sits at $1.2bn, just over a billion.

Is now a good time to buy Phantom (FTM)?

While FTM may not rally in a big way in the near future, there are other high-potential crypto projects that are worth investing in alongside Fantom. Accordingly, we review the top 15 cryptocurrencies for 2023, as analyzed by crypto news Industry Talk Team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of cryptonews.com.