The number of bitcoin wallet addresses holding non-zero balances could soon hit an all-time high, according to Glassnode data, with the latest price rally that has seen the world’s largest cryptocurrency increase in value by nearly 40% this year. , which it appears. new investors.

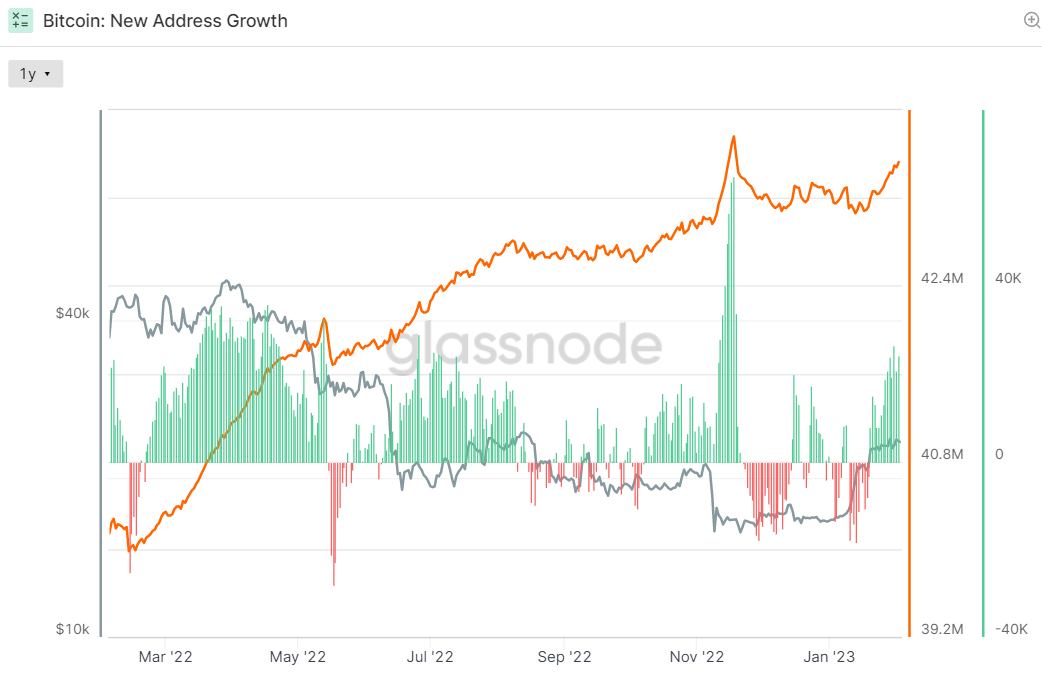

According to crypto analytics firm, 43,525,546 were Bitcoin Addresses with non-zero balances on the second day of February, up nearly 300,000 from this time last month. The record high number of non-null addresses of 43,759,663 was hit last November in the immediate aftermath of the collapse of one of the world’s largest cryptocurrency exchanges, FTX.

At the time, this caused a flurry to withdraw crypto from several exchanges. Bitcoin Owner is creating a self-custody wallet for the first time. However, the non-zero address bitcoin wallet numbers rapidly returned to their pre-FTX collapse levels as a result of capitulation due to the price collapse during the following month.

But the recent recovery in non-zero address numbers suggests that between of bitcoin Impressive rally since the start of the year, investors are once again returning to the bitcoin market in greater numbers than they are leaving it. If the number of non-zero wallet addresses continues to grow at the pace it has over the past few weeks, a new all-time high could be hit by the end of the month/early March.

What does this mean for BTC?

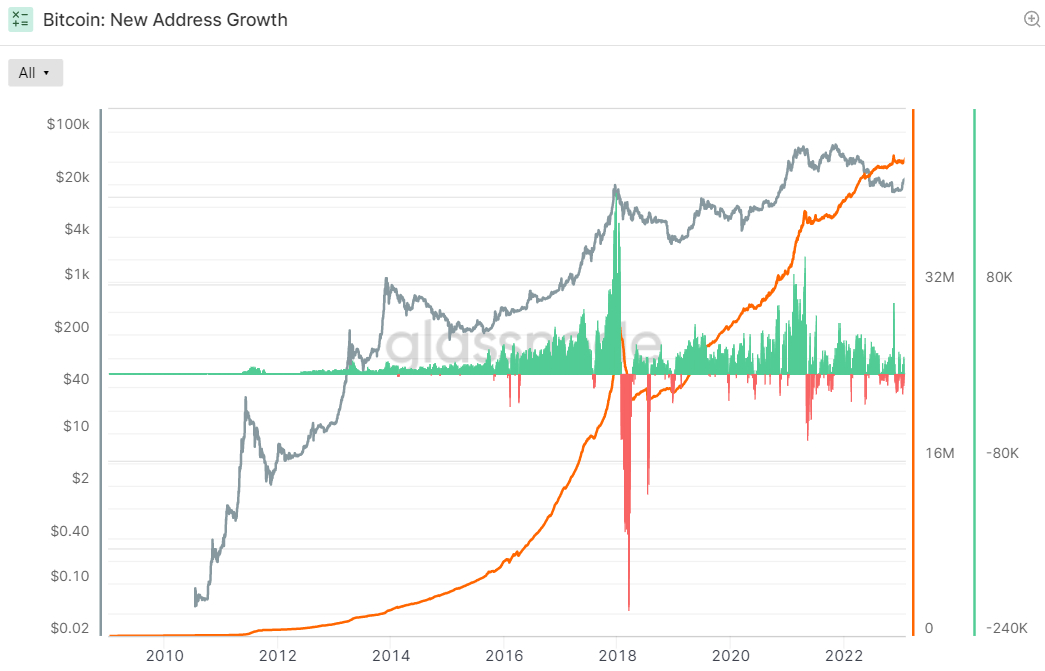

Despite the bear market of 2022, the number of non-zero bitcoin addresses has continued to grow steadily. However, in previous bull cycles, such as the run up to the 2017 peak and late 2020/early 2021, the pace of creation of new non-zero addresses has been much higher.

In the absence of continued rapid growth in the number of non-zero wallets, a sign that new investors are entering the market to pump up the price, bitcoin may struggle to gain further ground. Thus bitcoin bulls may be hoping that the latest increase in non-zero address numbers represents the start of a continued rise, and that bitcoin will likely continue to attract new buyers in the early stages of a new bull market.

Indeed, several different on-chain leading indicators are all showing bullish signs. As discussed in a recent articleSeven out of eight key on-chain and technical indicators tracked by crypto analytics firm Glassnode’s “recovering from bitcoin bears” are now indicating that the next bitcoin bull market could be here. Glassnode’s dashboard analyzes whether bitcoin is trading above dominant pricing models, whether network usage is picking up momentum, whether market profitability is returning, and whether the balance of USD-denominated bitcoin wealth is shifting to long-term HODLers. is in favor of

However, things can happen bumpy for bitcoin In the near future. Bitcoin didn’t initially react as bullish as the Fed policy announcement on Wednesday, but a super-strong January release US Jobs Report rekindled bets that the US economy could finally avoid a recession this year. This could mean that the Fed will raise interest rates higher for a longer period of time, a possibility that could trigger some short-term profit-taking in bitcoin.