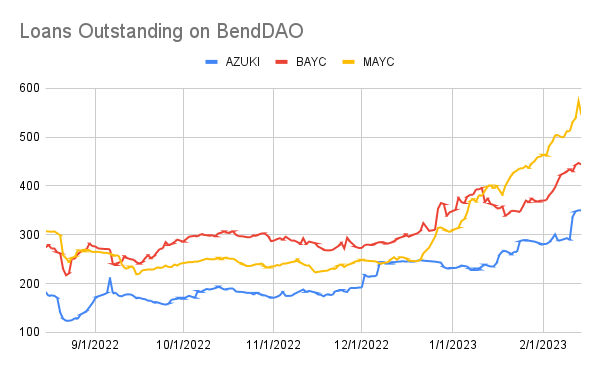

BendDAO, the largest NFT lending platform by market cap, hit new all-time highs last month on the backs of 4,399 individual loans, many of them Azukis, Mutants and BAYC.

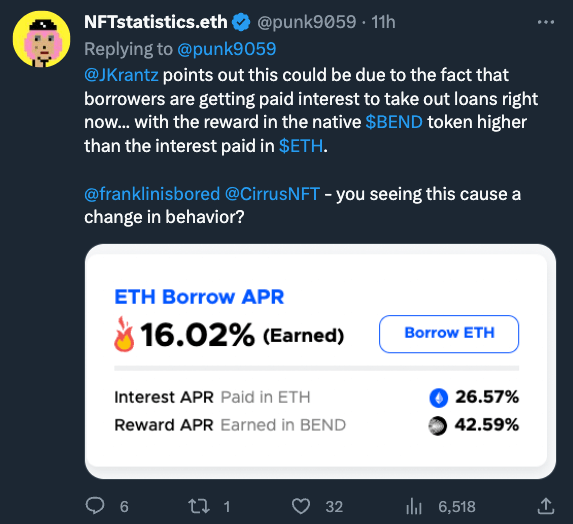

Twitter user @JKrantz speculated that the sudden all-time high might be because borrowers are getting paid a higher interest to take out loans on their NFTs with the native BEND token, which has seen a spike in growth over the last month.

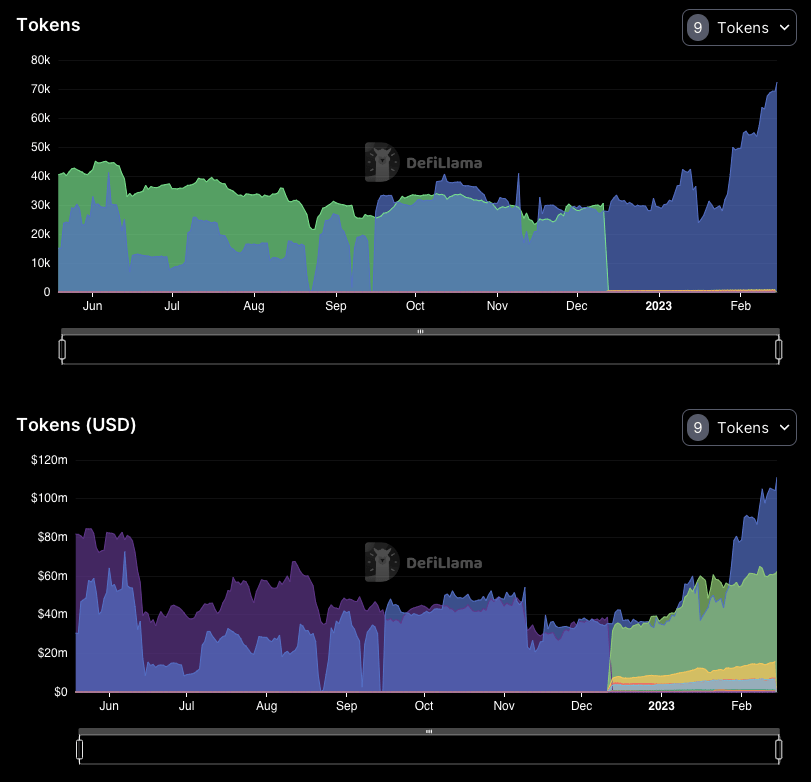

In the last 30 days, BEND has been up 377.5%, which some say is the reason why loans are flocking to the platform, as borrowers can yield a much high rate of return on their assets if they accept the native BEDN token over ETH.

BendDAO is considered a “peer-to-pool” lending protocol. Though more recently, newer NFT lending sites such as pwn.xyz have sprung up. Unlike BendDAO, pwn.xyz does not have pricing oracles and seeks to instead facilitate the borrower and the lender to set the terms of the loan themselves. In its current version, it also does not charge any fees (BendDAO currently charges a fee equal to 30% of the total interest income collected on NFT loans).

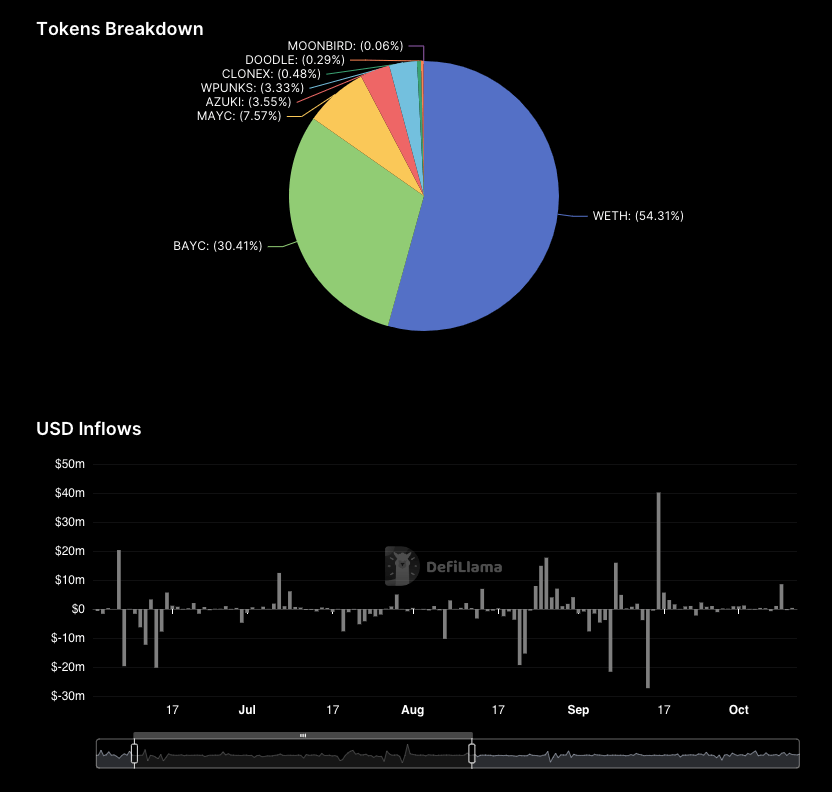

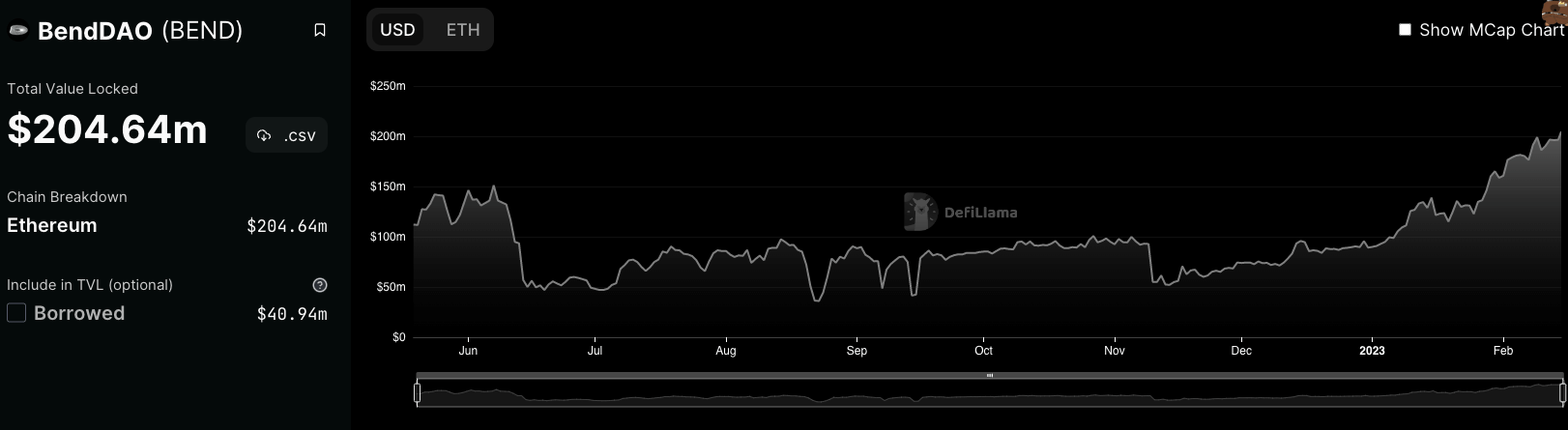

BendDAO is by far the largest NFT lending protocol by market cap. It currently has over $200 million worth of assets locked up on its platform, more than 4x of what its competitors have combined.

BEND is currently trading at $0.0265.

The protocol’s spike in activity comes on the heels of a record month of loans in the NFT lending industry writ large.

In Jan., BendDAO saw an ATH in terms of monthly loan volume and the number of loans. A total of 17.9K ETH, worth approximately $28 million, spread across a total of 4,399 loans.

The good, the bad and the ugly with NFT lending protocols

In Aug. 2021, BendDAO weathered a bank run that saw 15,000 ETH withdrawn from the contract within a 48-hour time period.

News that could have ended up calamitous for bendDAO, given that it had many bid-less debt-ridden NFTs listed on its platform, many of which had extremely distressed floor prices during that time as well.

Situations can arise for large NFT lenders like BendDAO when there is a broader market downturn and lenders engage in competition to retrieve their funds on NFTs with distressed floor prices.

In such cases, recovery of funds may be impossible.

However, the reverse is also possible. A lender may be given an asset that becomes worth significantly more during the loan maturation period. And in the case of a default, the lender may end up with an NFT worth a lot more than for what it was collateralized.

The sector overall continues to do well.

In January, CryptoSlate reported that NFT lending had overall its highest monthly volume throughout January 2023. Outside of the market leader, BendDAO, other platforms such as NFTfi, X2Y2, and Arcade made up an additional $44.8 million that month.

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?