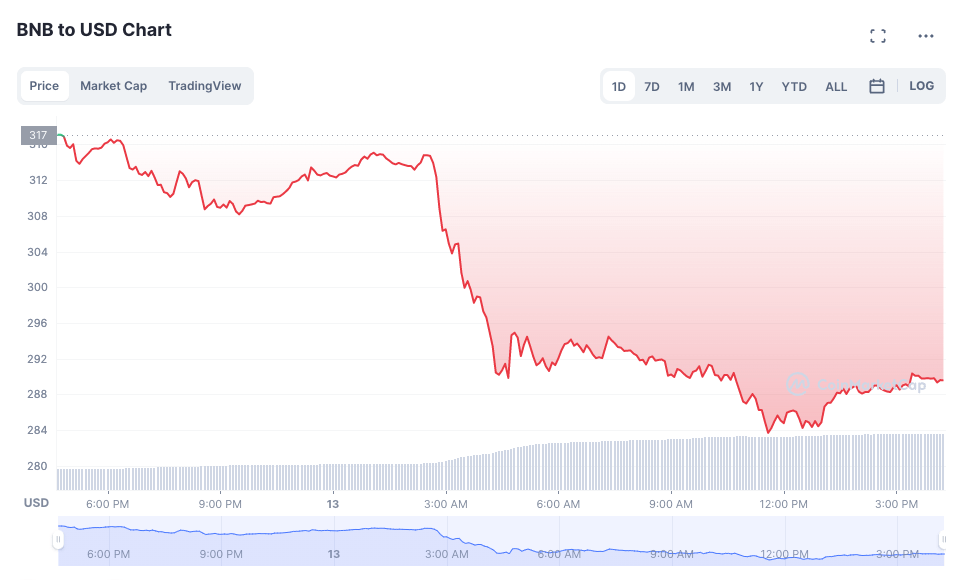

Binance Coin has fallen more than 9% today as investors mull the prospect of increased regulatory scrutiny in light of an SEC warning that the Binance stablecoin may be considered a security.

The news comes after it emerged late last week that US-based blockchain entity, Paxos, would suspend its issuance of Binance USD (BUSD) after scrutiny from US regulators.

BNB is now trading below US$300 — in the range of $289.5 — for the first time since Jan. 17.

The Paxos Trust Company is a New York-based fin-tech company specializing in blockchain technology founded in 2012. It admitted to having been served a Wells Notice lawsuit by the SEC over its issuance of BUSD, the Binance stablecoin pegged to the US dollar.

Reports are also now emerging that BUSD’s $15 billion dollar stablecoin market cap may now be up grabs, with Bloomberg reporting earlier today that Circle had told the New York watchdog that Binance’s stablecoin was not fully backed.

USDC and USDT have a combined market cap of $109 billion, more than 7x the $15 billion market cap of BUSD.

In a Twitter thread published on Feb. 13, CZ admitted that he might have been outfoxed. “We do foresee users migrating to other stablecoins over time,” CZ admitted. “And we will make product adjustments accordingly. e.g., move away from using BUSD as the main pair for trading, etc.”

Nevertheless, CZ said that he hopes the US regulators will not issue a notice declaring BUSD a security, adding that “given the ongoing regulatory uncertainty in certain markets, we will be reviewing other projects in those jurisdictions to ensure our users are insulated from any undue harm.”