Definition

- Future’s open interest is the total funds (USD Value) allocated in open futures contracts.

- Liquidations are the sum liquidated volume (USD Value) from long and short positions in futures contracts.

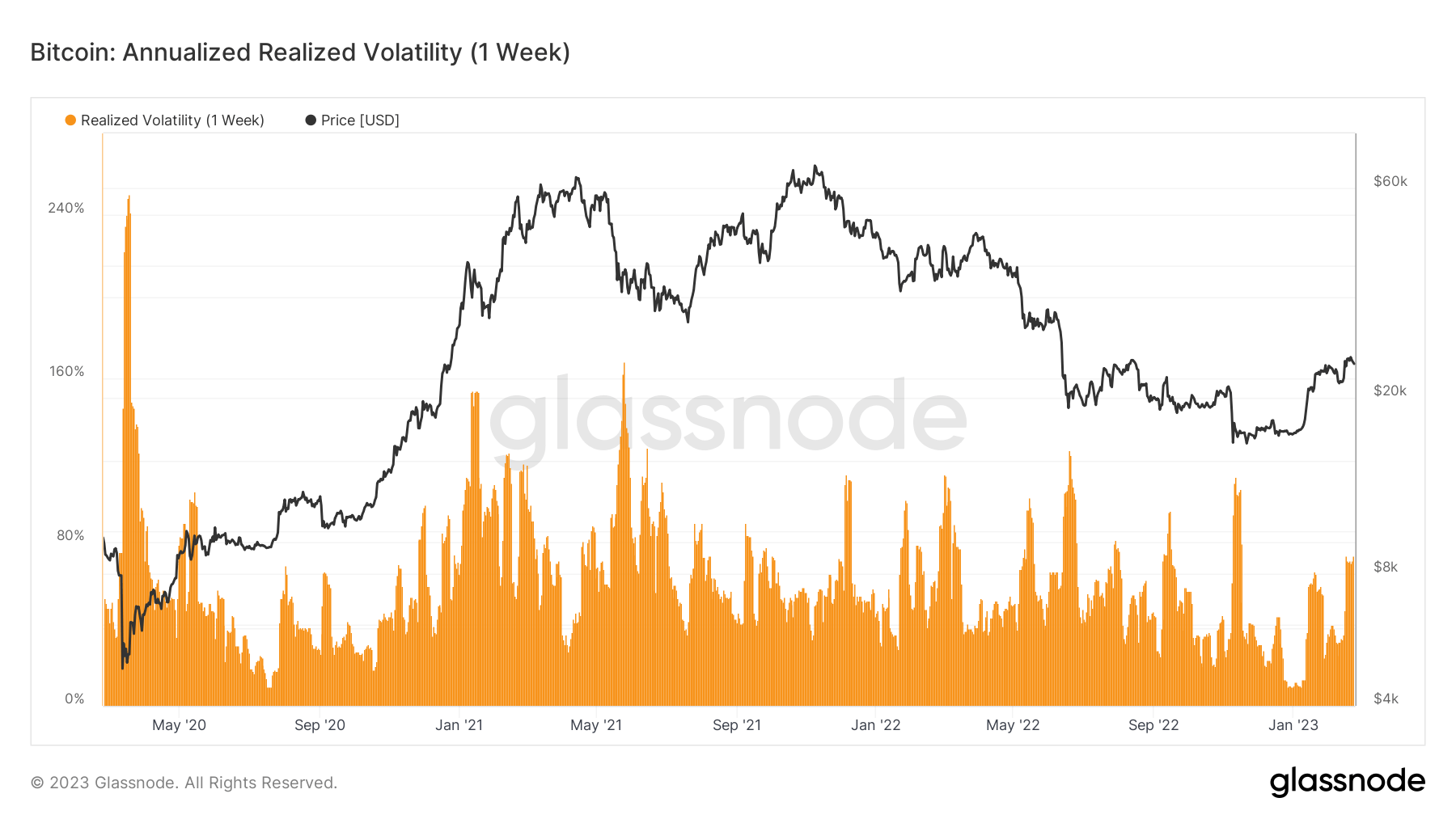

- Realized volatility is the standard deviation of returns from the mean return of a market. High values in realized volatility indicate a phase of high risk in that market.

Quick Take

- Futures open interest exceeds 500k Bitcoin for the first time in February, as investors pile into futures contracts, an increase of over 20k BTC in February.

- As a result of an increase in futures contracts has seen an increase in liquidations in February, mainly long liquidations, as investors continue to pile into the positive momentum of Bitcoin is up 50% YTD.

- In addition, the realized volatility has also picked up, adding to Bitcoin price volatility by over 70% vol the highest level since the collapse of FTX.

The post Futures OI exceeds 500K Bitcoin – volatility, liquidations increase as a result appeared first on CryptoSlate.

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.