The bullish momentum that propelled Bitcoin (BTC) price to a 2023 high of $25,000 initially on Feb. 16 and Feb. 20 appears to have waned. The pause in bullish momentum appears connected to higher-than-expected U.S. inflation data, the possibility of the Federal Reserve continuing higher interest rate hikes and large amounts of long liquidations.

The contraction in Bitcoin price follows a market-wide decline, and analysts fear that the crypto market continues to face considerable danger from the the United States’ Federal Reserve’s interest rate decisions.

Let’s take a closer look at the factors impacting Bitcoin price today.

Stocks drop on high inflation data

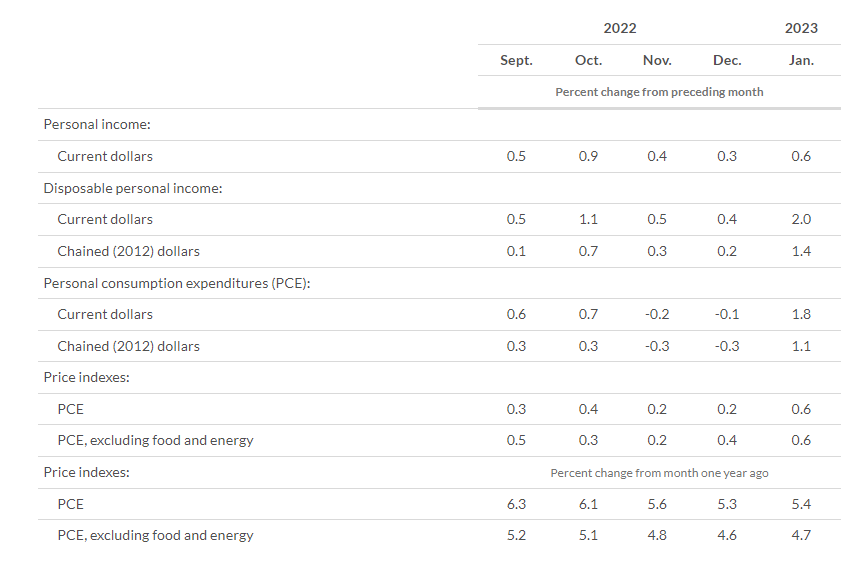

Stocks and Bitcoin tumbled after the Bureau of Economic Analysis (BEA) released the Personal Consumption Expenditures (PCE) report on Feb. 24 which showed inflation rising 5.4% in January compared to the previous year. Core inflation, which is one of the Federal Reserve’s favorite tools to gauge inflation, was up 4.7% compared to January 2022.

While the correlation between Bitcoin and stocks hit its lowest level since 2021 on Feb. 22, Bitcoin price remains closely correlated to equities and the stock market. Investors have previously expressed strong concerns about a potential upcoming recession in the U.S. economy.

While some analysts believe Bitcoin’s current price represents a generational buying opportunity at current levels, others believe BTC’s close correlation to the U.S. dollar index (DXY) and equities is reflected by the price weakness to retain the $24,000 level.

Bitcoin price is reacting to the market’s consensus expectation that inflation is not yet under control which will lead the Federal Reserve to continue raising interest rates.

Rising interest rates in the U.S. and abroad weigh on Bitcoin price

The PCE report is the Federal Reserve’s favorite tool to gauge inflation. And with Federal Reserve Chairman Powell still aiming to reach 2% overall inflation, further interest rate hikes are expected. Inflation has been a determining factor in raising interest rates. In order to combat inflation, Chairman Powell may not be able to pivot the aggressive rate hike strategy.

The PCE report is leading the market to speculate that a 0.5% interest rate hike is possible at the FOMC meeting on March 22.

On the back of persistently sticky inflation, some analysts believe Bitcoin is in for a cold winter and the price could continue to see volatility leading into the FOMC.

On Feb. 24, in a span of 5 hours, over $95 million in Bitcoin longs were liquidated. When BTC longs are liquidated without buy pressure from trading volume, Bitcoin price is negatively affected. While China’s recent monetary easing injected $92 billion in liquidity to the Chinese economy, it did not stop BTC longs from being liquidated.

Is there a chance for Bitcoin price to reverse course?

On Jan. 23 and Jan. 24, the Bitcoin futures market saw $230 million in liquidations on long positions. This put further pressure on BTC price. When BTC longs are liquidated without buy pressure from trading volume, Bitcoin price is negatively affected.

Related: Bitcoin 2024 halving will be its ‘most important’ — Interview with Charles Edwards

The recent uptick in Bitcoin trading volume could be because of Binance’s removal of trading fees. Vetle Lunde, senior analyst at Arcane Research presumed from data that:

“However, volumes are still concentrated on Binance following Binance’s removal of trading fees. Volumes on the other spot exchanges sit below the peaks from January at $680m, as Binance’s volume still represents 95% of the daily BTC spot volume.”

If this is the case, that means there is not a large cushion of buy pressure for Bitcoin long liquidations leading to further downside. And with recent Securities and Exchange Commission (SEC) actions against Binance, more assets are flowing from exchanges.

The short-term uncertainties in the crypto market do not appear to have changed institutional investors’ long-term outlook. According to BNY Mellon CEO Robin Vince, a poll commissioned by the bank found that 91% of institutional investors were interested in investing in tokenized assets in the following years.

CME, a leading tool for institutional investors to gain Bitcoin exposure, has seen its dominance grow in 2023. Open interest in CME’s Bitcoin future has grown by 8,000 BTC since Feb. 17.

Data shows CME BTC options also representing a majority of Bitcoin’s open interest.

Futures premiums are rising.

CME’s basis sits at 8.7%, the highest since Nov 2021, trading at a premium to offshore futures’ 6.3%.

CME also accounts for 68.2% of the BTC futures market, excluding perps. The futures dominance offshore has fallen steadily throughout the year. pic.twitter.com/wxxiCJNh9H

— Vetle Lunde (@VetleLunde) February 24, 2023

In the short term, worries are high with Bitcoin price being directly impacted by macroeconomic events, and it is also likely that potential rate hikes at the next FOMC is also having some effect on BTC price.

In the long term market participants still expect the price of Bitcoin to go up, especially as more banks and financial institutions are seemingly turning to digital cash for settlement purposes even amidst the chaos.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article opened my eyes, I can feel your mood, your thoughts, it seems very wonderful. I hope to see more articles like this. thanks for sharing.