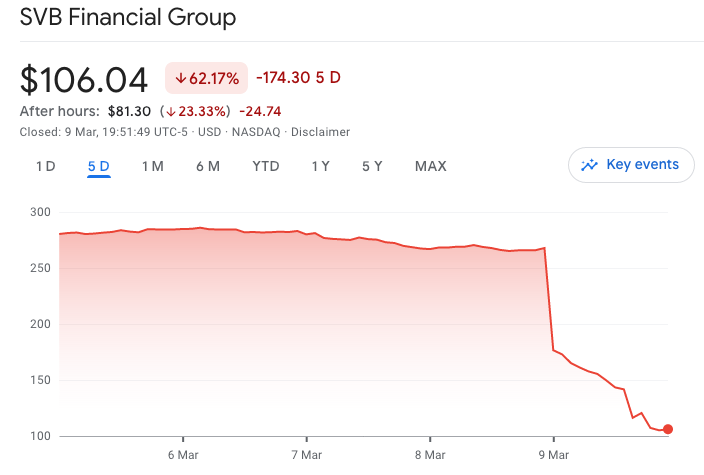

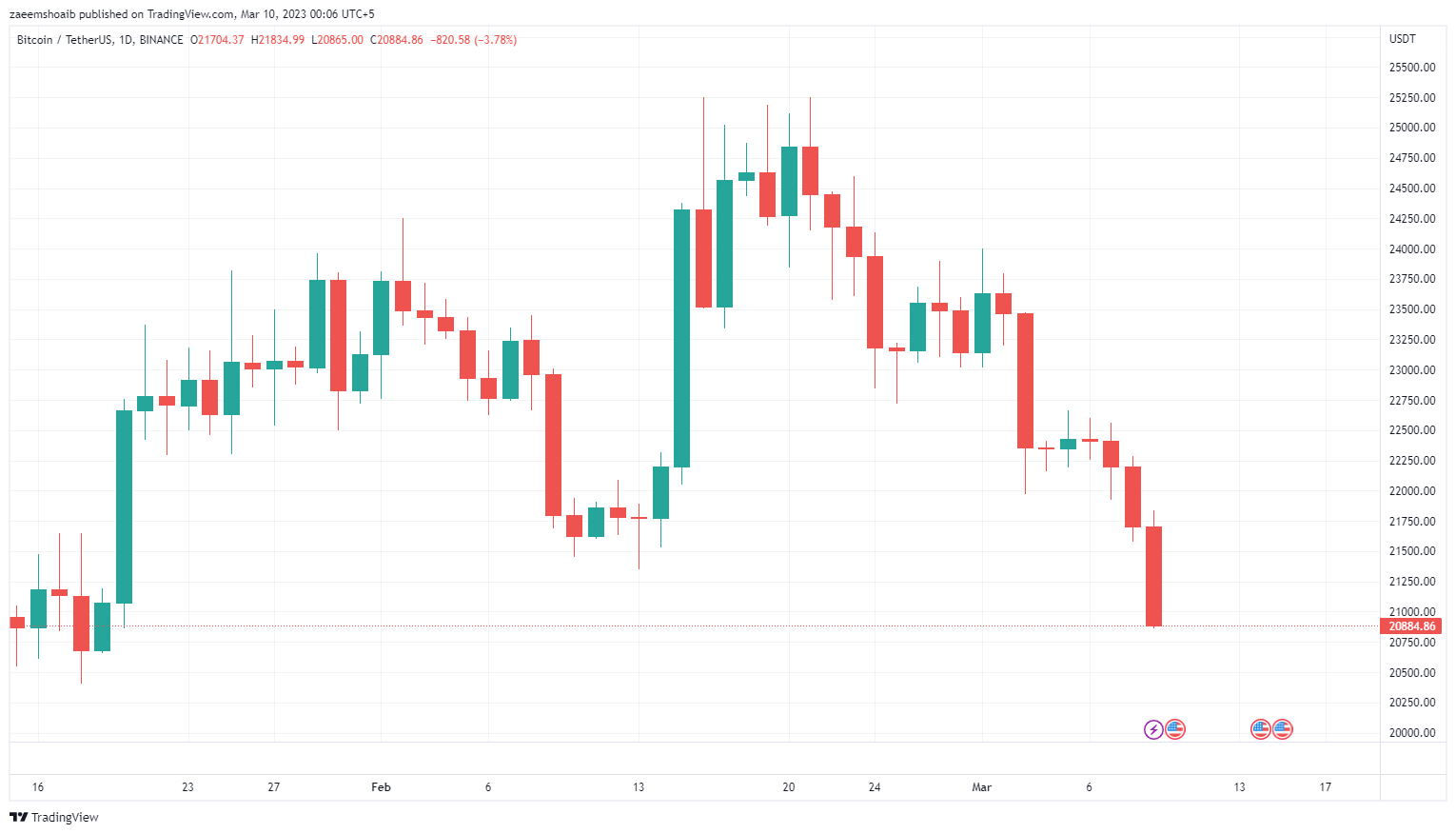

Bitcoin has lost crucial support at the $21,000 level as market volatility has continued after the collapse of Silvergate.

On Thursday, the prices of cryptocurrencies experienced a decline following the announcement by Silvergate, a prominent bank in the industry, of its decision to close down. Coin Metrics reported that Bitcoin fell by 6% to a sub $21,000 support for the first time since January 17.

Silvergate continues to haunt $BTC

While some investors have found bitcoin’s recent lateral movement encouraging, given a series of negative industry developments, chart analysts have been looking for the cryptocurrency to close above $25,000 to provide more significance to its year-to-date gains, which are presently around 30%.

The decline started late Wednesday, shortly after Silvergate Capital declared its intention to wind down operations and liquidate its crypto-friendly bank. However, the size of the decrease suggests that investors in the cryptocurrency market had already factored in the news when Silvergate issued its initial warning last week about the possibility of ceasing operations and shutting down the Silvergate Exchange Network (SEN).

Moreover, with last week’s joint warning by the Fed, FDIC, and OCC to banks regarding the liquidity risks associated with banking crypto companies has added to the anxiety surrounding the industry.

FTX and broader regulatory hurdles

With the macro situation also adding downward pressure on Bitcoin, ongoing litigation in the U.S. over FTX, as well as several cryptocurrency legislation currently being debated; the world’s oldest crypto appears to be going through a cycle of fear, uncertainty and doubt.

Bitcoin also drops in volume

Following the collapse of Silvergate Bank and its voluntary liquidation, bitcoin traders are taking a pause and assessing their next moves. Transfer volume denominated in BTC has decreased by 35% in the last 24 hours, while the total number of transactions on the Bitcoin blockchain has dropped by 17%. Additionally, the number of active addresses has fallen by 10%, according to data by Crypto Quant.

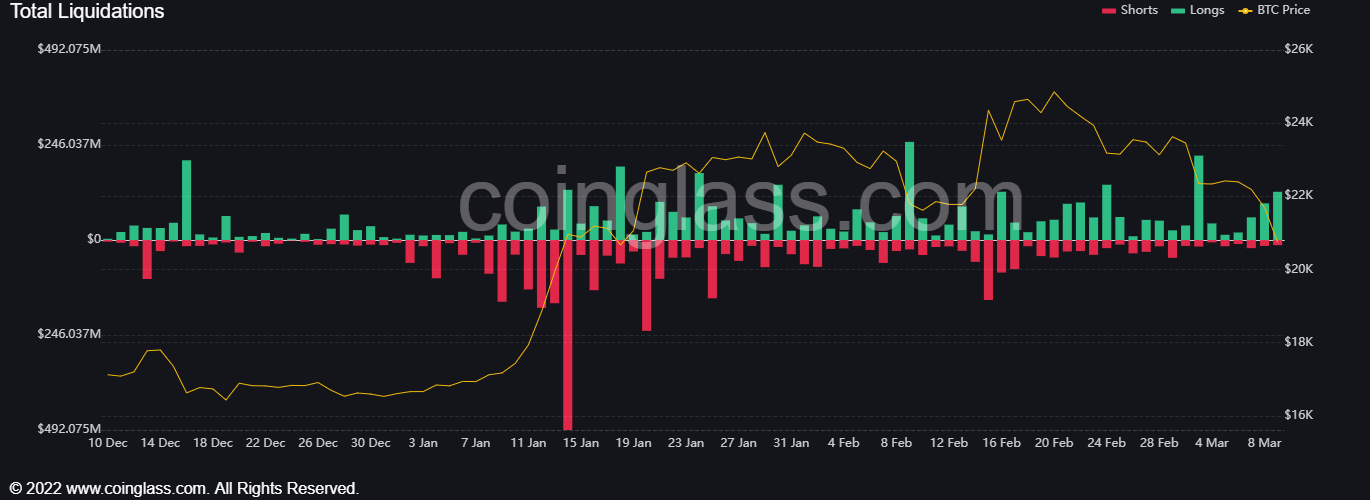

BTC liquidations

On March 8, Coinglass monitoring resource reported that $24.4 million worth of BTC longs were liquidated, marking the highest figure in almost a week. In total, including altcoins, $95 million of longs and $15.4 million of shorts were liquidated on March 8.

Glassnode, an on-chain analytics firm, provided additional data indicating the predominance of long liquidations over short liquidations.

In March, bitcoin trading volume averaged around $25 billion, compared to approximately $36 billion in February, according to CoinGecko data. Kaiko, a Paris-based crypto data provider, noted in a Monday memo reported in Coin Desk that with Silvergate’s downfall, stablecoins are likely to become even more prevalent among traders, as traders will deposit their dollars with a stablecoin issuer, receive stablecoins, and then transfer them to an exchange.