Huobi has set up a $100 million liquidity fund following a 90% flash crash of the exchange’s Huobi Token (HT) on March 9.

The exchange’s global adviser Justin Sun confirmed this development, adding that the funds have been sent to the exchange.

HT is yet to recover from its flash crash fully. According to CryptoSlate’s data, the token is down 21% and is trading for $3.80 as of press time.

Why Huobi is setting up the 100M liquidity fund

According to Sun, HT’s sudden collapse was caused by “a few users, ” triggering a cascade of forced liquidations in the spot and HT contract markets. However, he added that these fluctuations were simply a result of market behavior.

Kaiko data researcher Riyad Carey said the HT token had around $2 million worth of sell orders against $600,000 buy orders five minutes before the crash. In addition, the broader crypto market witnessed a massive sell-off during the same period, liquidating over $300 million in long positions.

Sun said Huobi would improve its multi-currency liquidity by setting up the $100 million liquidity fund to forestall a future recurrence. He added:

“We will continue to improve the liquidity depth of main cryptocurrencies and HT token, strengthen leverage risk warnings and liquidity capabilities.”

Meanwhile, the Tron founder promised Huobi would “bear all leverage-through position losses on the platform [that] resulted from this market volatility event of HT.”

Huobi sees outflows

In the last 24 hours, Huobi’s reserve dropped by $72.4 million, according to CryptoQuant’s data.

CryptoQuant data showed that the exchange saw a $33.1 million outflow in Bitcoin (BTC), $10.3 million in Ethereum (ETH), a cumulative flow of $13.9 million in other altcoins, and $14.8 million in stablecoins.

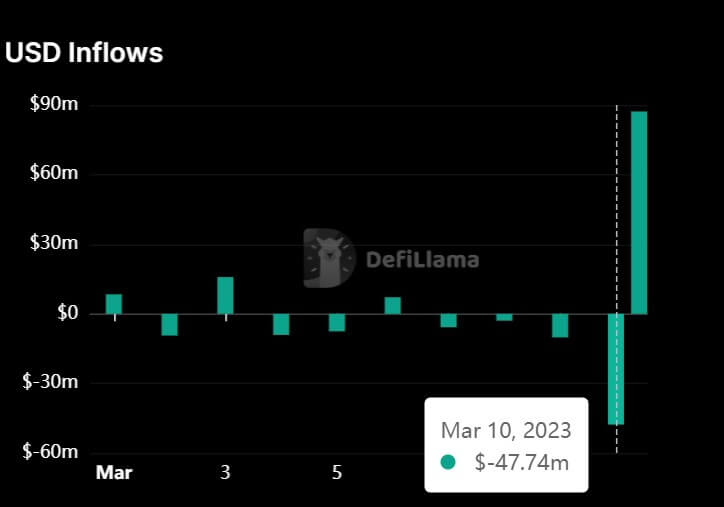

DeFiLlama data corroborated that Huobi has seen outflows during the reporting period. The data aggregator said the exchange’s outflow was $47.74 million.

Meanwhile, the exchange saw an inflow of $87.22 million that the $100 million liquidity fund heavily influenced.

Nansen data showed that Huobi reserves hold $2.8 billion in digital assets. The exchange’s native token accounts for 26.61% of its reserves, while Tron’s TRX makes up roughly 20%.