The stablecoin ecosystem felt an immediate effect as USD Coin (USDC) depegged from the US dollar due to a subsequent sell-off after Silicon Valley Bank (SVB) did not process $.3.3 billion of Circle’s $40 million transfer request. Given USDC’s collateral influence, major stablecoin ecosystems followed suit in depegging from the dollar.

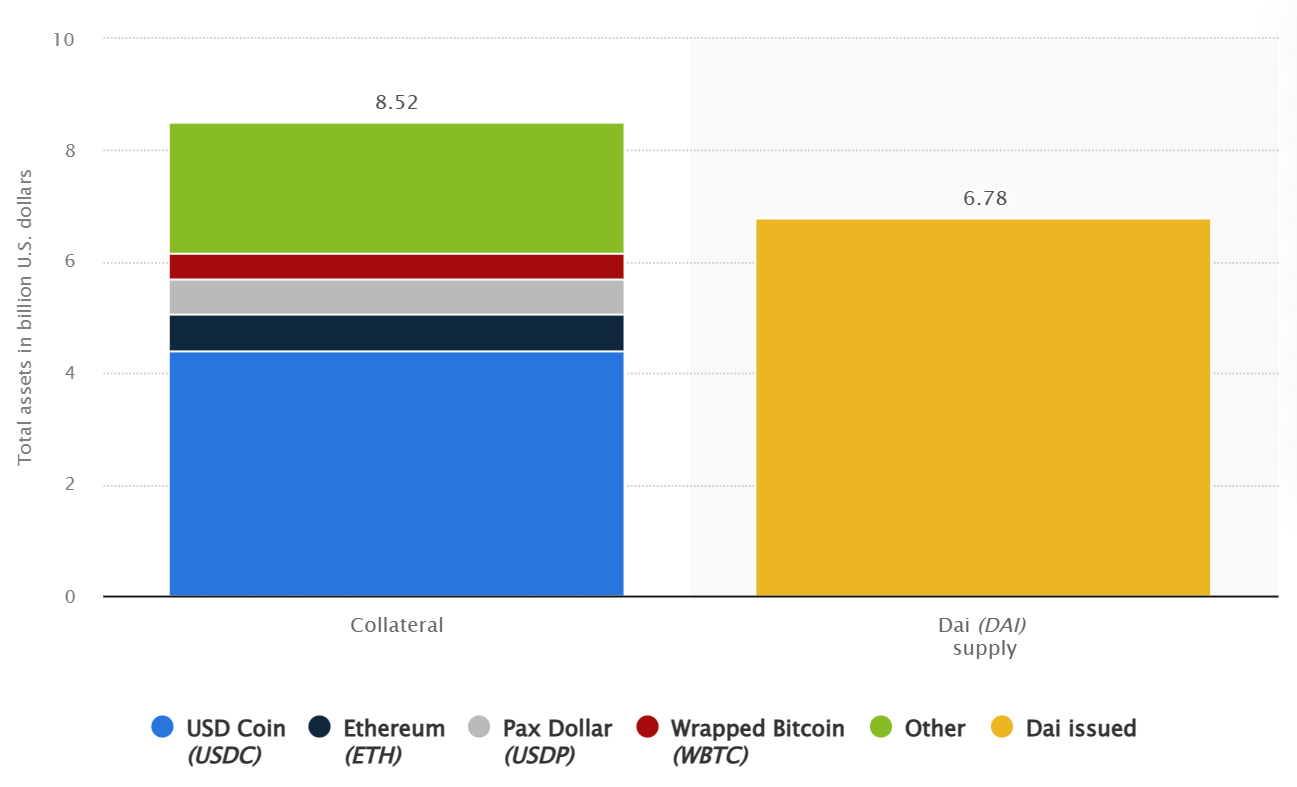

Dai (DAI), a stablecoin issued by MakerDAO, lost 7.4% of its value as a result of USDC’s depegging. As of June 2022, $6.78 billion worth of DAI supply was collateralized by $8.52 billion worth of cryptocurrencies, confirms data from Statista.

Out of the lot, USDC represented 51.87% of DAI’s collateral, worth $4.42 billion. Other prominent cryptocurrencies include Ether (ETH) and Pax Dollar (USDP) at $0.66 billion and $0.61 billion respectively.

As a result, DAI depegged from the dollar to momentarily touch $0.897. The stablecoin recovered to trade around the $0.92 mark at the time of writing, as shown below.

USD Digital (USDD), another stablecoin issued by Tron blockchain, and fractional-algorithmic stablecoin Frax (FRAX) shared a similar fate due to negative market sentiments. USDD responded to the USDC sell-off with a nearly 7.5% drop to trade at $0.925 while FRAX dipped even further to $0.885.

Other popular cryptocurrencies, such as Tether (USDT) and Binance USD (BUSD), continue to maintain a 1:1 peg with the US dollar.

Related: USDC investor shells out $2M to receive $0.05 USDT trying to evade crash

The entire depegging ordeal started after Circle announced that $3.3 billion of its funds were not processed for withdrawal by SVB.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

SVB was ordered to shut down by the California Department of Financial Protection and Innovation for undisclosed reasons. However, the California regulator appointed the Federal Deposit Insurance Corporation as the receiver to protect insured deposits.