During the week ending March 15, two Federal Reserve backstop facilities were utilized by US banks to borrow a total of $164.8 billion.

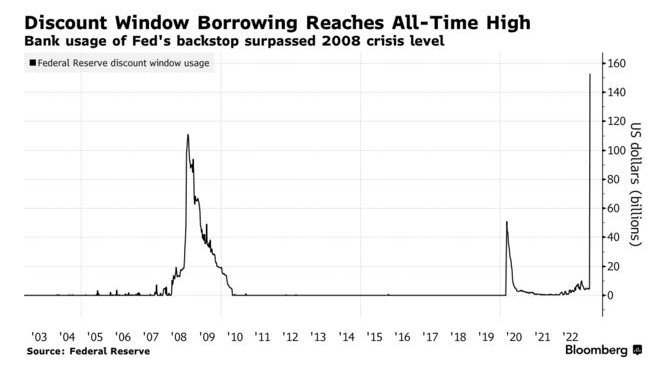

The traditional liquidity backstop for banks, also known as the discount window, saw a record-high borrowing of $152.85 billion, which increased significantly from the previous week’s $4.58 billion.

According to a March 17 report in Bloomberg, this surpasses the all-time high of $111 billion reached during the 2008 financial crisis.

According to the data, the Bank Term Funding Program, which is a new emergency backstop launched by the Fed on Sunday, recorded $11.9 billion in borrowing. The combined credit extended through both backstops highlights that the banking system is still vulnerable and struggling with deposit outflows resulting from the recent collapses of Silicon Valley Bank of California and Signature Bank of New York.

Banking contagion

On March 16, the largest banks in the country reached an agreement to deposit roughly $30 billion with First Republic Bank as part of an initiative led by the US government to stabilize the struggling California-based lender.

This after the decision last weekend by the US Treasury and the Federal Deposit Insurance Corp. (FDIC) to safeguard all depositors of SVB and Signature, going beyond the usual deposit insurance limit of $250,000.

However, Reuters reported that any bank bidding for Signature, one of the distressed banks that had a bank account belonging to Circle, would be forced to give up any crypto-related aspects of the business.

As it means for crypto, Circle, the founders of the second largest stablecoin market cap, USDC, the stablecoin was eventually able to get to its $1.00 peg, despite trading to as low as .88 cents over the weekend.

Read more: Circle says substantially all USDC minting, redemption backlogs are resolved after wild week

“Trust, safety, and 1:1 redeemability of all USDC in circulation is of paramount importance to Circle,” CEO Jeremey Allaire said on a March 16 episode of the Bankless podcast.

“I’m a very deep believer in full-reserve banking,” Allaire added, the “idea that we don’t need to have a fractional reserve, where the base layer in government obligation money, and the payment system innovation built on top is done via the internet using software.”