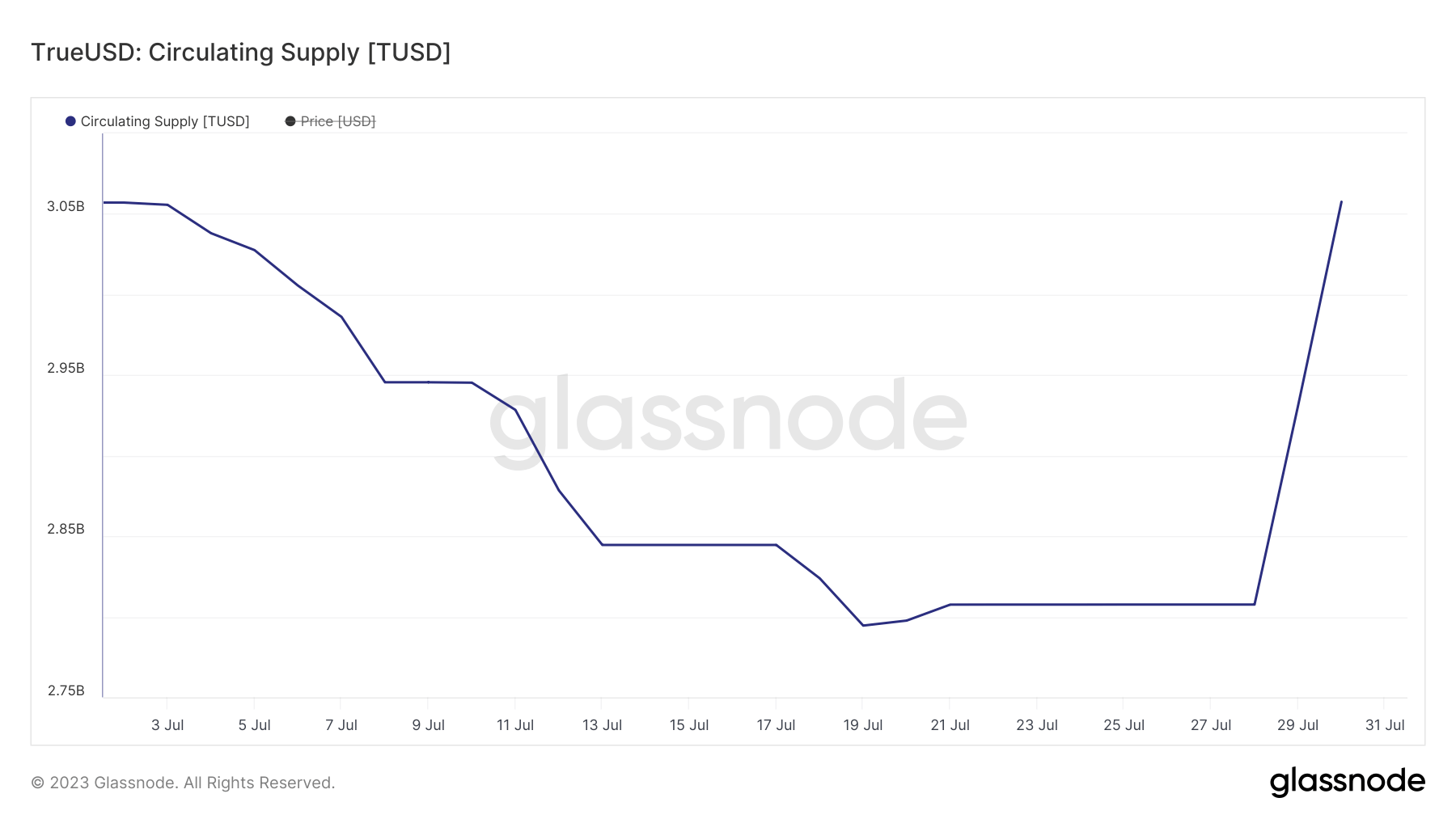

The circulating supply of TrueUSD (TUSD), a highly liquid stablecoin, has seen a significant increase of almost $250 million between July 29 and July 30.

While this might appear as a minor uptick for a stablecoin with a circulating supply exceeding $3 billion, historical data suggests that notable price rallies have often followed such spikes in the stablecoin’s supply in Bitcoin.

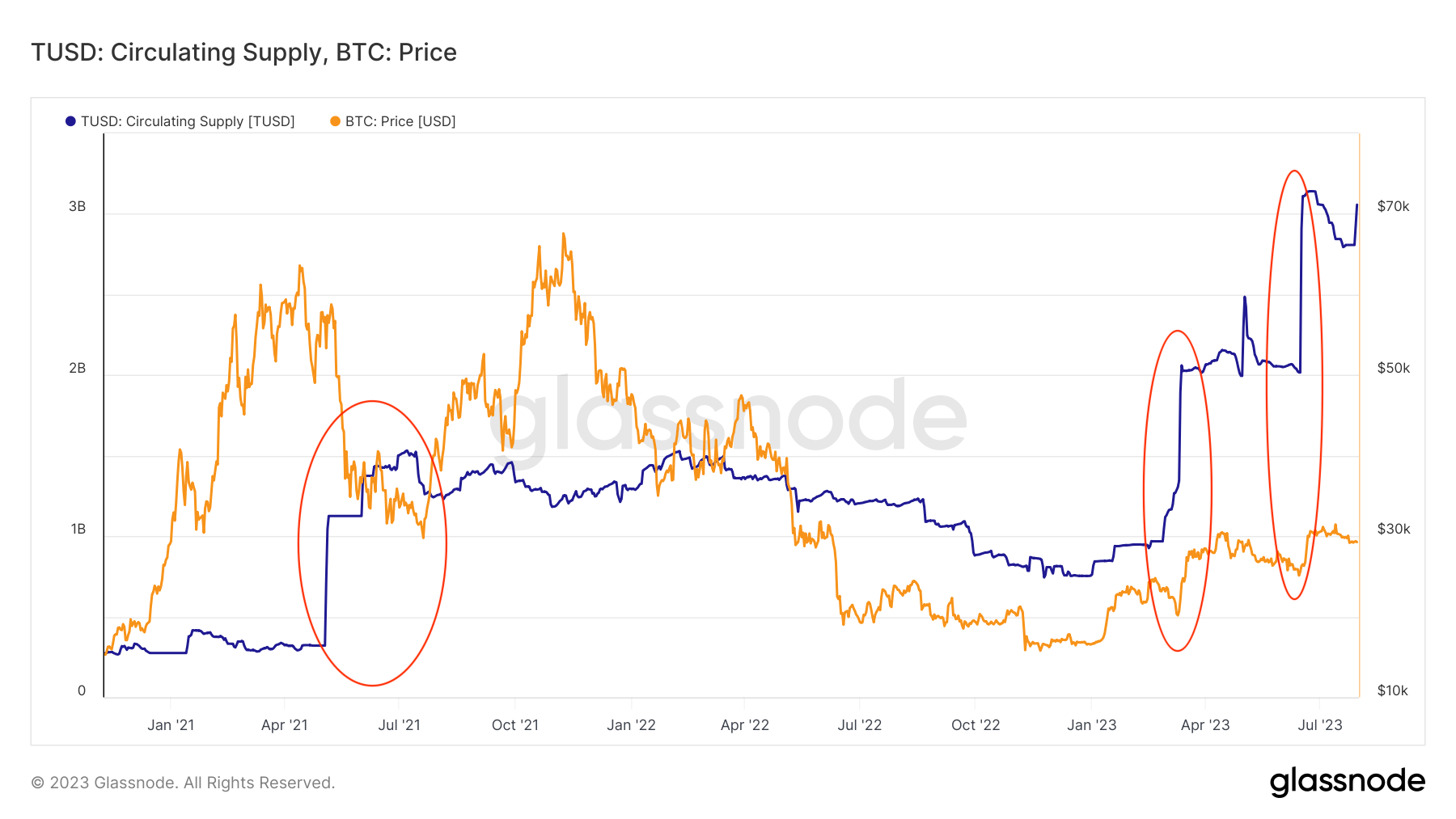

For instance, in early May 2021, TUSD added $800 million to its supply within just five days. Then, in mid-July, following an additional increase of $400 million that took the TUSD supply to a peak of $1.5 billion, Bitcoin began a significant rally. In the days following this peak, Bitcoin’s price soared from $30,800 to its ATH of $68,000 by November.

A similar pattern emerged in February 2023. Between February 26 and March 15, the TUSD supply grew by almost $1.1 billion. This substantial increase in supply preceded a Bitcoin rally that pushed its price from $20,000 to $30,000.

More recently, between June 14 and June 26, TUSD supply experienced another significant increase of $1.1 billion. This surge in supply coincided with Bitcoin reclaiming its position above $30,000 for the second time this year.

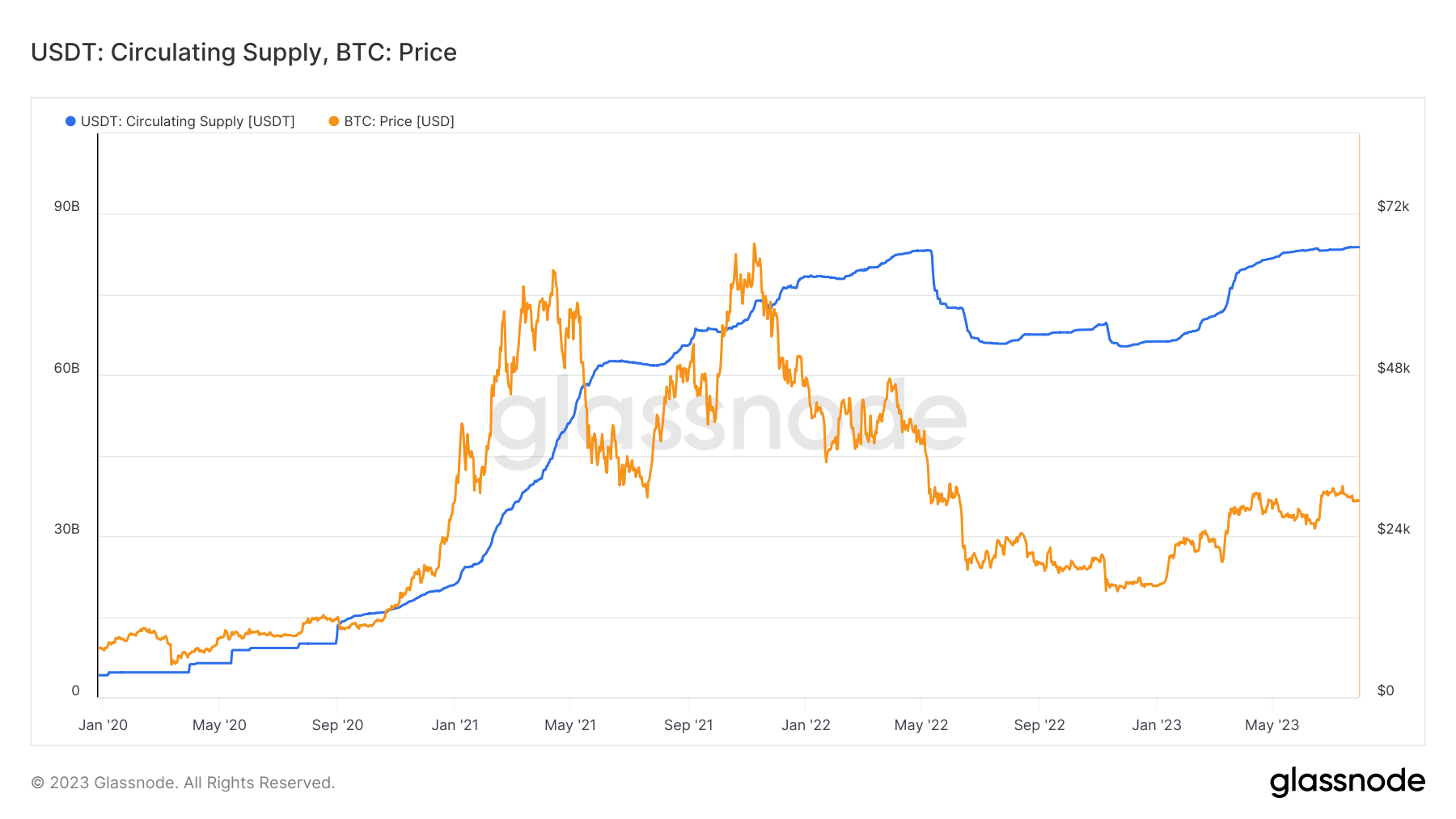

Interestingly, this correlation appears to be unique to TUSD. Other stablecoins, such as Tether (USDT), have not demonstrated a similar pattern.

For instance, changes in USDT supply have typically occurred in tandem with Bitcoin’s price movements rather than preceding them.

The recent surge in TUSD supply could potentially signal another Bitcoin rally on the horizon. However, investors should approach this correlation with caution.

While the data suggests a pattern, it does not necessarily mean that a surge in TUSD supply will always lead to a Bitcoin rally.

The post Could a new surge in TUSD supply trigger another Bitcoin rally? appeared first on CryptoSlate.

list of otc allergy medications different types of allergy medicine allergy pills over the counter