Quick Take

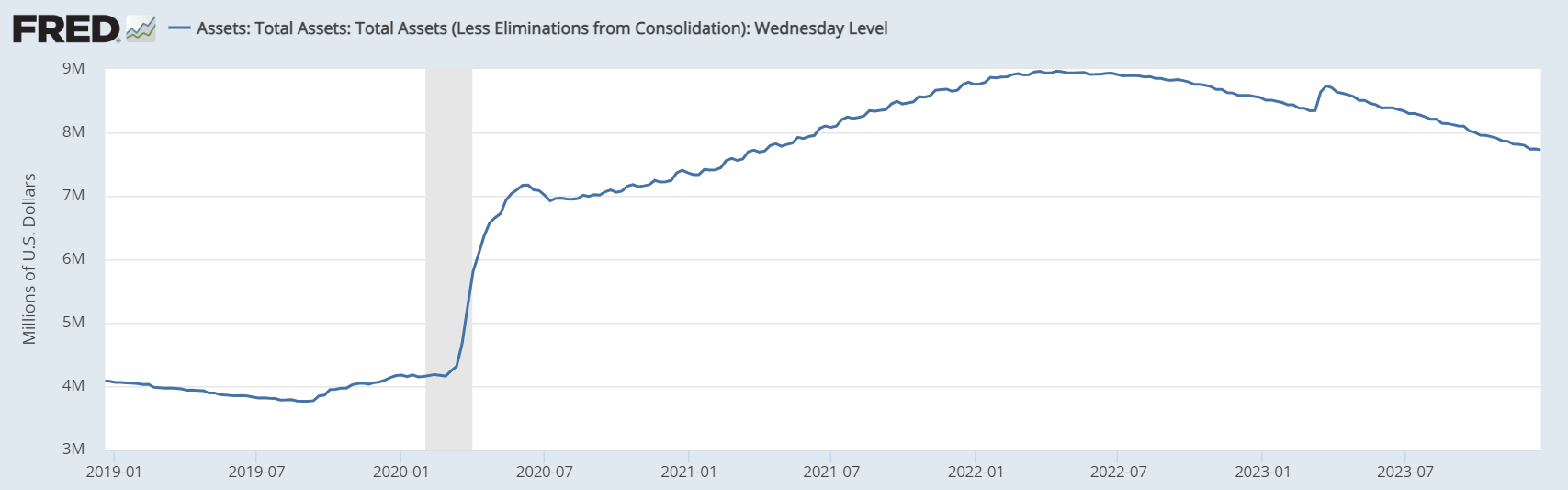

A recent examination of the Federal Reserve’s balance sheet reveals a significant trend of quantitative tightening.

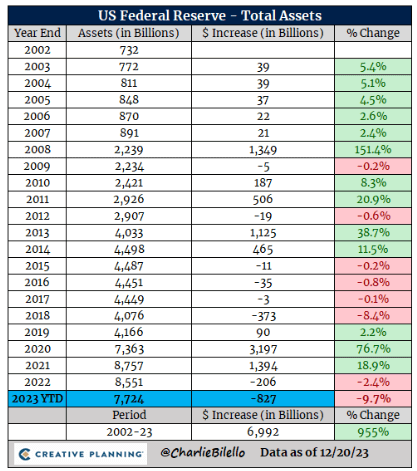

The balance sheet has contracted by approximately $15 billion in the past week alone, signaling possible upcoming economic shifts. As noted by Charlie Bilello, the Chief Market Strategist at Creative Planning, 2023 may set new records in balance sheet reduction: a decrease of $827 billion in absolute terms and a 9.7% decrease in percentage terms, the lowest level since April 2021.

Historically, the Fed has typically responded to economic downturns by injecting liquidity into the market through quantitative easing. The balance sheet expanded by 151% in the midst of the 2008 recession and by 77% during the COVID-19 crisis in 2020.

The current trend of contraction prompts questions about the Fed’s strategy should another recession occur. It’s unclear whether the Fed will continue its current policy of quantitative tightening or revert to expanding the balance sheet as in previous economic challenges. This uncertainty, combined with its potential effects on different sectors, underscores the importance of closely monitoring the Federal Reserve’s balance sheet movements.

The post Fed’s balance sheet hits lowest point since April 2021 appeared first on CryptoSlate.