Flipside Crypto reported that blockchain users and activity grew throughout 2023 in a report shared with CryptoSlate on Jan. 25.

The analytics company wrote:

“Crypto recently has been fluctuating through extremes, with on-chain activity and user sentiment swinging wildly throughout the last year … but ultimately, the past many months have concluded on a high note, with user growth and activity surging across nearly every major chain.”

Flipside notably observed growth in acquired users, defined as users that have carried out at least two transactions on a blockchain.

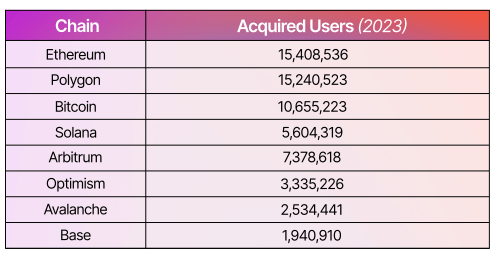

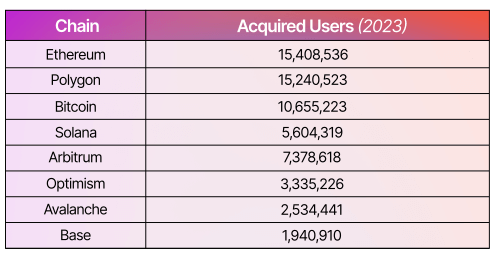

One chart in the report indicates that eight major blockchains experienced 62 million acquired users. The company noted that Ethereum (ETH) and Polygon (MATIC) saw the most user acquisitions, each with about 15 million acquired users over the year.

Bitcoin, meanwhile, saw 10.7 million acquired users over 2023. Other chains saw considerably less growth, as seen below:

Flipside noted that user acquisition peaked in May 2023 as 5.8 million users executed their second on-chain transaction on various chains.

It added that user acquisition began to rise in March alongside the collapse of Silicon Valley Bank, which may have reduced trust in centralized financial services and driven users to decentralized alternatives. Flipside added that user acquisition gradually dropped off after May before rising again in December.

It also noted specific trends for each blockchain. Flipside said that Polygon (MATIC) set a record for January by acquiring 2 million users that month. It added that Avalanche (AVAX) saw accounts surge in March to 481,000 amidst the launch of a euro stablecoin.

Furthermore, Arbitrum (ARB) and Optimism (OP) attracted hundreds of thousands of users, likely due to airdrops.

Finally, Flipside noted that Coinbase’s Layer 2 network, Base, saw a strong start with 633,000 users in the month of its launch, August 2023. However, according to the report, the chain saw lesser growth toward the end of the year.

Predicted trends for 2024

In predicting future trends, Flipside noted that 2023 saw a decline in NFT-related activity and a shift toward to decentralized finance (DeFi) activity.

As such, it suggested that the next activity cycle will similarly be dominated by various DeFi activities rather than NFT trading. Flipside suggested that decentralized exchange (DEX) trading and yield farming will continue to be predominant applications. Furthermore, it predicted the rise of new DeFi applications such as the Ethereum restaking protocol Eigenlayer.

The company said users will likely interact with multiple chains at an increased rate in 2024, though most will continue to engage with just one chain.

Flipside also predicted that users will increasingly interact with Layer 2 networks in 2024. It noted that although users who interacted with more than one chain in 2023 were a minority, those who did so largely interacted with Layer 2s.

It added that higher transaction fees during the crypto market’s next bull run could drive Layer 2 networks to lower their costs for end users competitively. This could, in turn, increase interest in related governance tokens, it said.

Finally, Flipside predicted that new chains would launch in 2024 to meet new requirements and that these could offer specialization and diverse use cases.