Quick Take

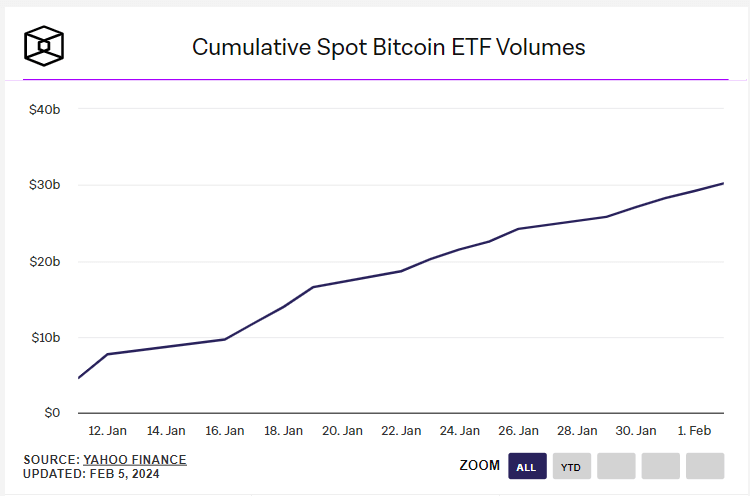

In the nascent arena of spot Bitcoin ETFs, competition is swiftly evolving. The first month saw a noteworthy $1.5 billion net inflow, representing about 32,000 Bitcoin, according to BitMEX Research. Moreover, the aggregated volume of these ETFs overpassed a landmark $30 billion threshold, according to The Block.

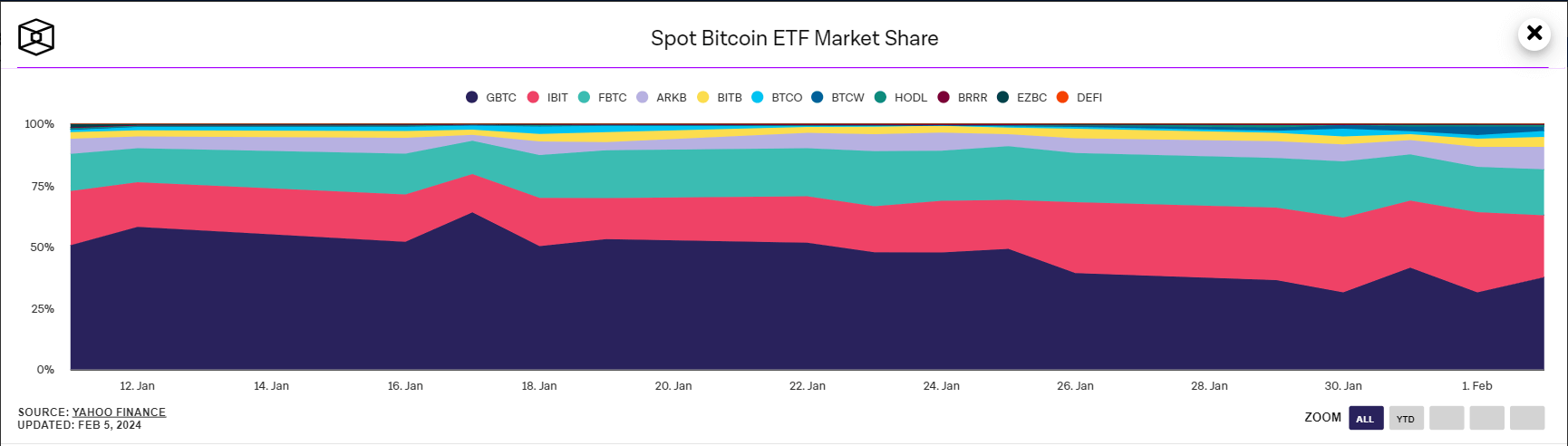

A shift in dominance among these Bitcoin ETFs was recorded. The initial supremacy of the Grayscale Bitcoin Trust (GBTC), which accounted for nearly 50% of the volume on its opening day, dwindled to 38% on Feb. 2.

Conversely, BlackRock’s IBIT and Fidelity’s FBTC ETFs have observed their shares grow by approximately 25% and 20%, respectively. This shift is primarily due to the competitive fee structures; GBTC’s fees are 1.5%, whereas FBTC and IBIT are set at a more attractive 0.25%.

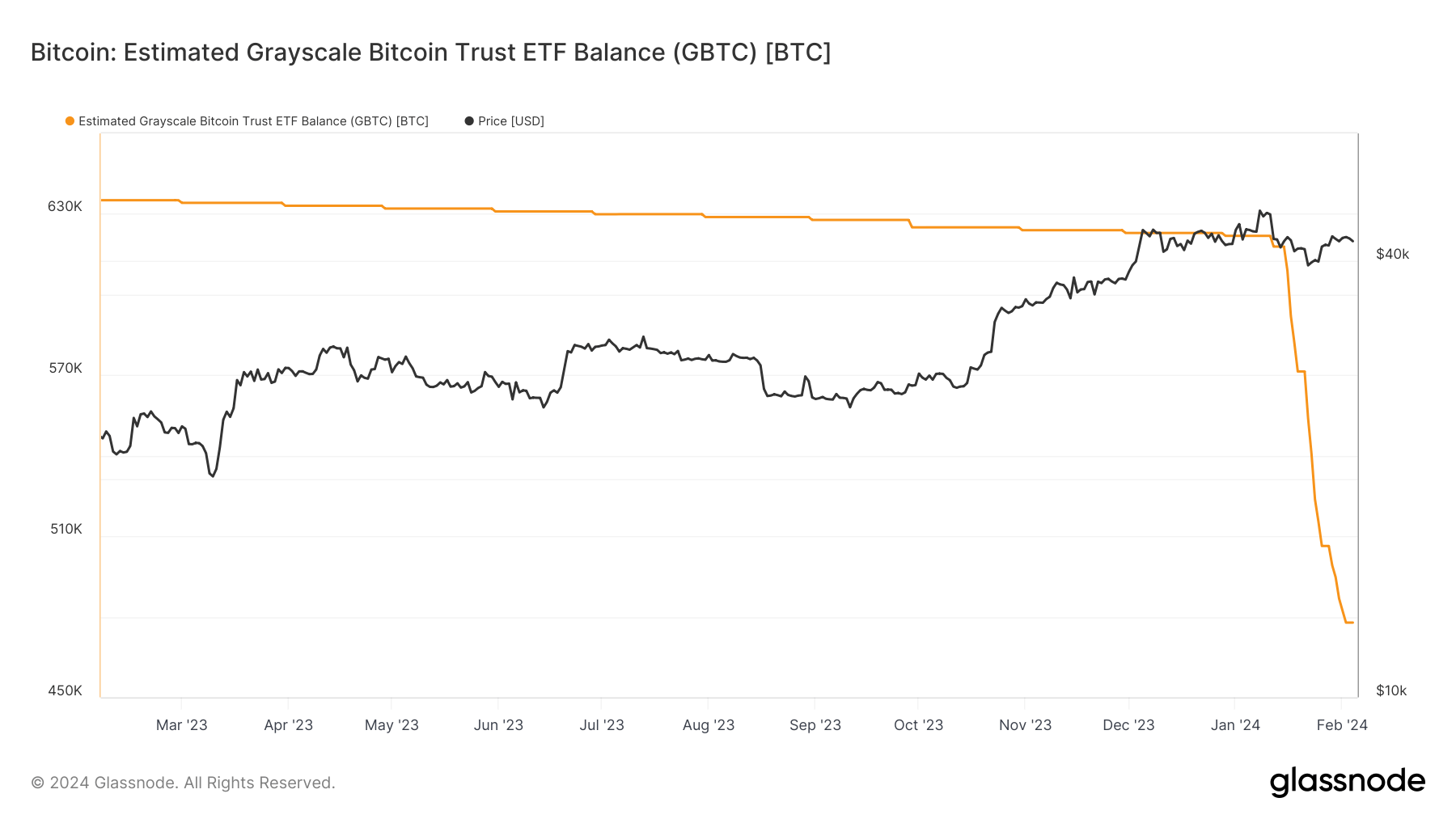

GBTC, which initially held 620,000 BTC before the ETFs started trading, now has approximately 477,000 Bitcoin, a 26% drop from the top.

This substantial decrease represents the enduring sell-off pressure within GBTC, even though the outflows are gradually decelerating. Furthermore, the potential for these coins to shift into the more cost-effective ETFs is occurring. Specifically, Bloomberg ETF analysts estimate that one-third of GBTC outflows are redirected into these spot ETFs.

The post Spot Bitcoin ETFs’ cumulative trading volume exceeds $30 billion appeared first on CryptoSlate.