Quick Take

The diminishing returns theory, suggesting that Bitcoin will yield lesser returns with each cycle, is a subject of intense scrutiny. The examination of this theory from two points of view, the cycle low and the cycle all-time high, provides interesting insights.

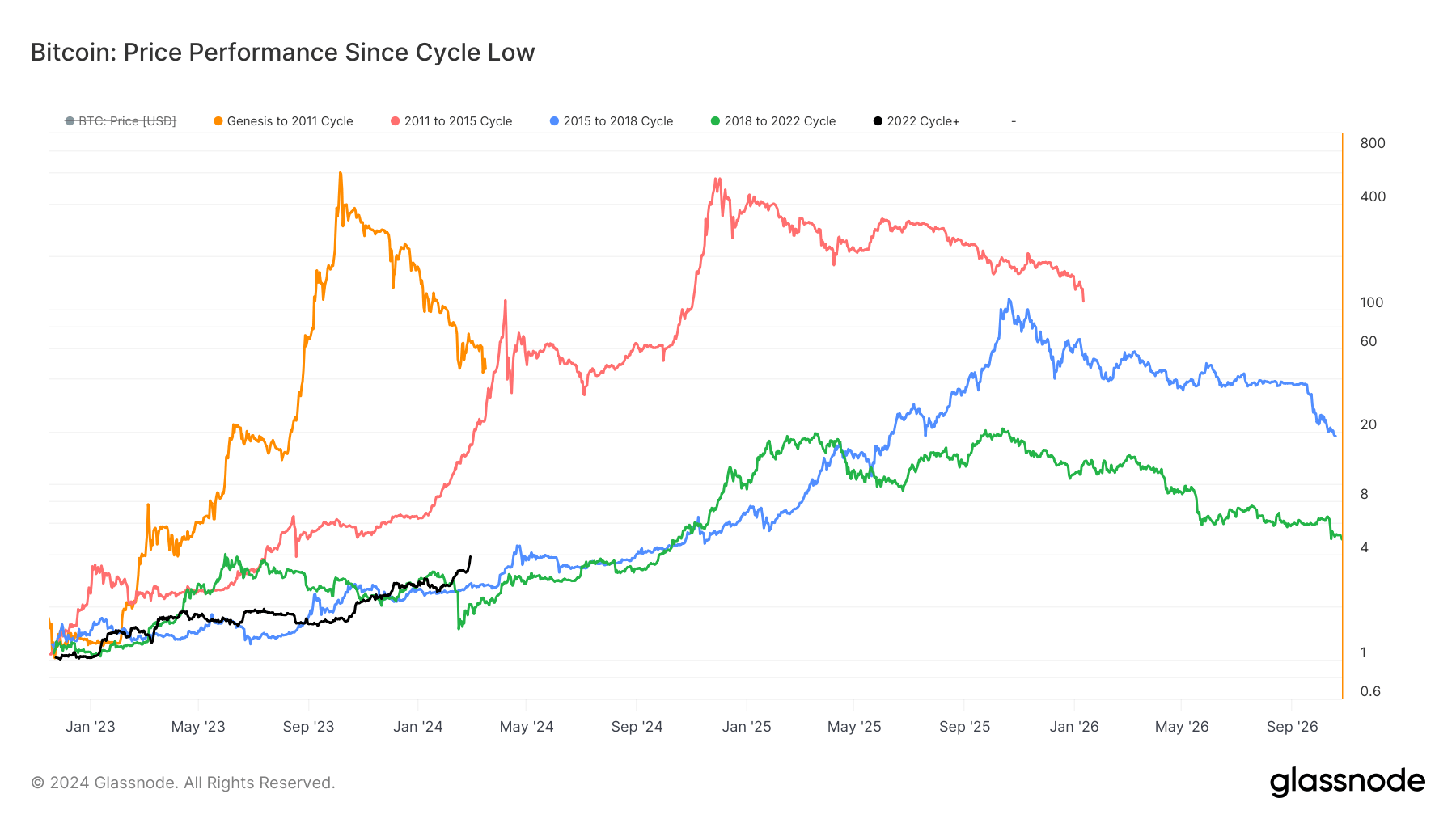

In November 2022, Bitcoin’s cycle low occurred during the FTX collapse, dropping to roughly $15,500. Since then, Bitcoin has managed a staggering 287% appreciation, outpacing the returns of the 2015 to 2018 cycle (173%) and the 2018 to 2022 cycle (106%).

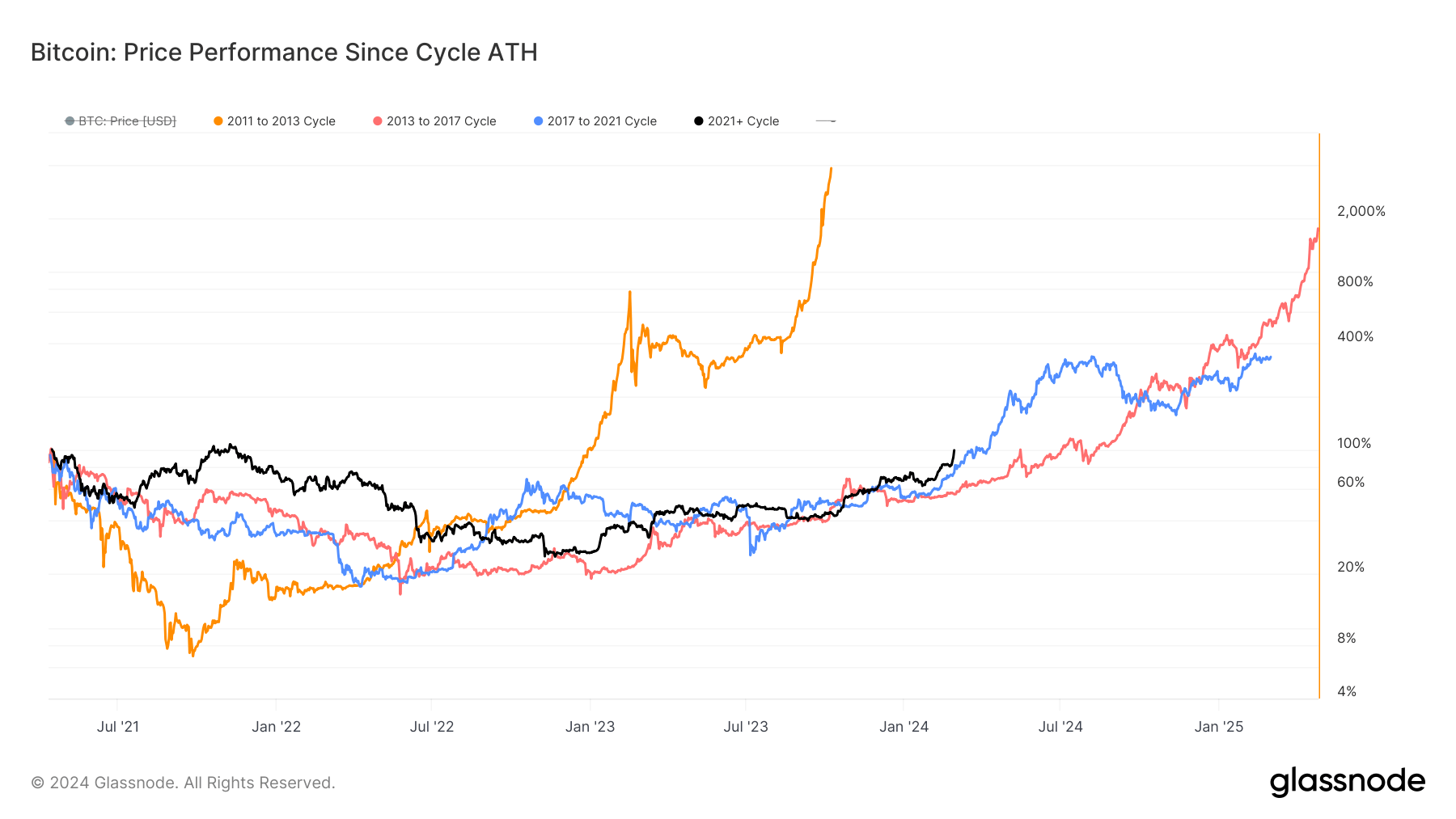

Considering the cycle from its all-time high, the bear market began shortly after the peak in April 2021, presenting a similar narrative.

We observe that Bitcoin has already hit its all-time high from April 2021 of roughly $63,000, a significant improvement compared to the previous cycles. At this juncture in the 2013 to 2017 cycle, Bitcoin needed roughly a 35% increase, and during the 2017 to 2021 cycle, a 20% increase was needed.

In conclusion, while this analysis doesn’t necessarily refute the diminishing returns theory, it highlights the strength of the current Bitcoin cycle.

The post Analysis challenges Bitcoin diminishing returns theory amid recent gains appeared first on CryptoSlate.