Quick Take

MicroStrategy (MSTR), the business intelligence firm renowned for its substantial Bitcoin holdings, experienced a significant share price decline of over 11% on March 28. The company’s shares are currently trading at $1,704, starkly contrasting the recently anticipated $2,000 mark reported by CryptoSlate just days earlier. Despite the recent setback, MSTR’s year-to-date performance remains impressive, with a remarkable 150% gain.

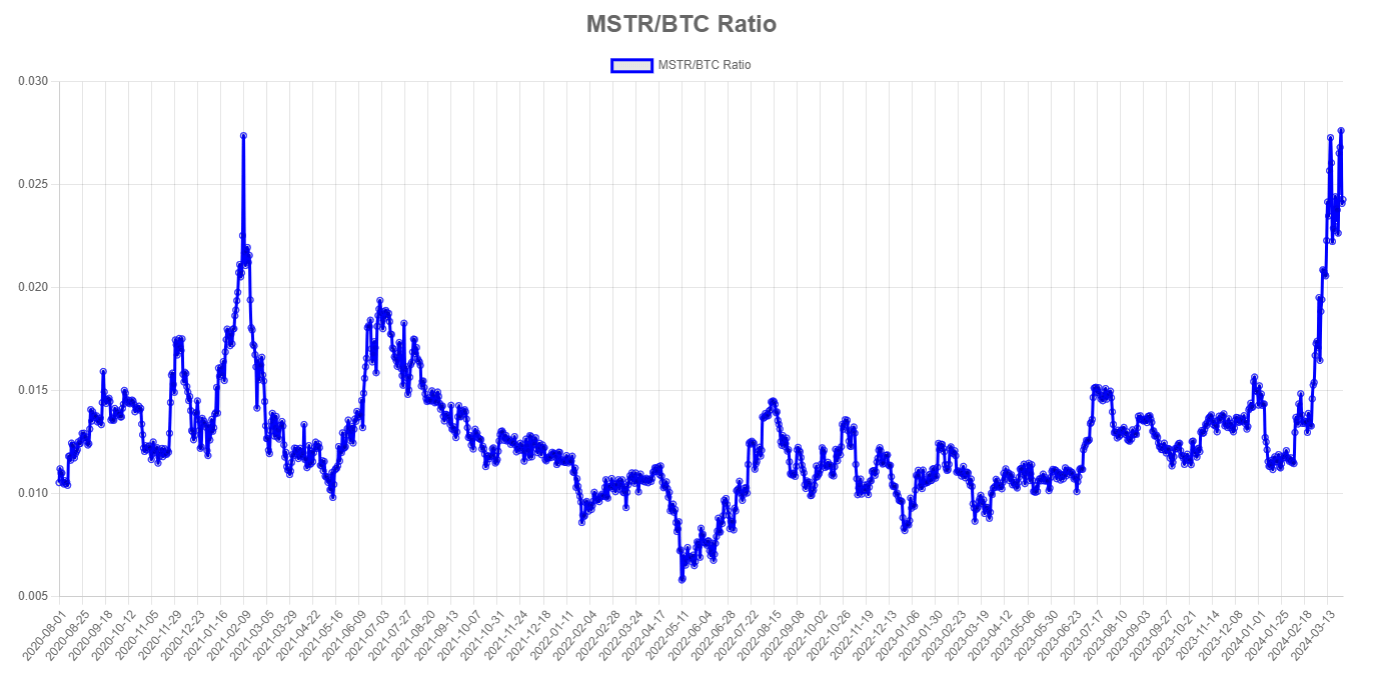

Analysts closely monitor the “MSTR/BTC Ratio,” a comparative value ratio between MicroStrategy’s stock price and the price of Bitcoin. This ratio illustrates how the company’s stock value trends in relation to Bitcoin’s market movements. Currently trading at 0.024, the ratio hit a recent high of 0.028, mirroring the levels observed in June 2021 at approximately 0.027, according to mstr-tracker.

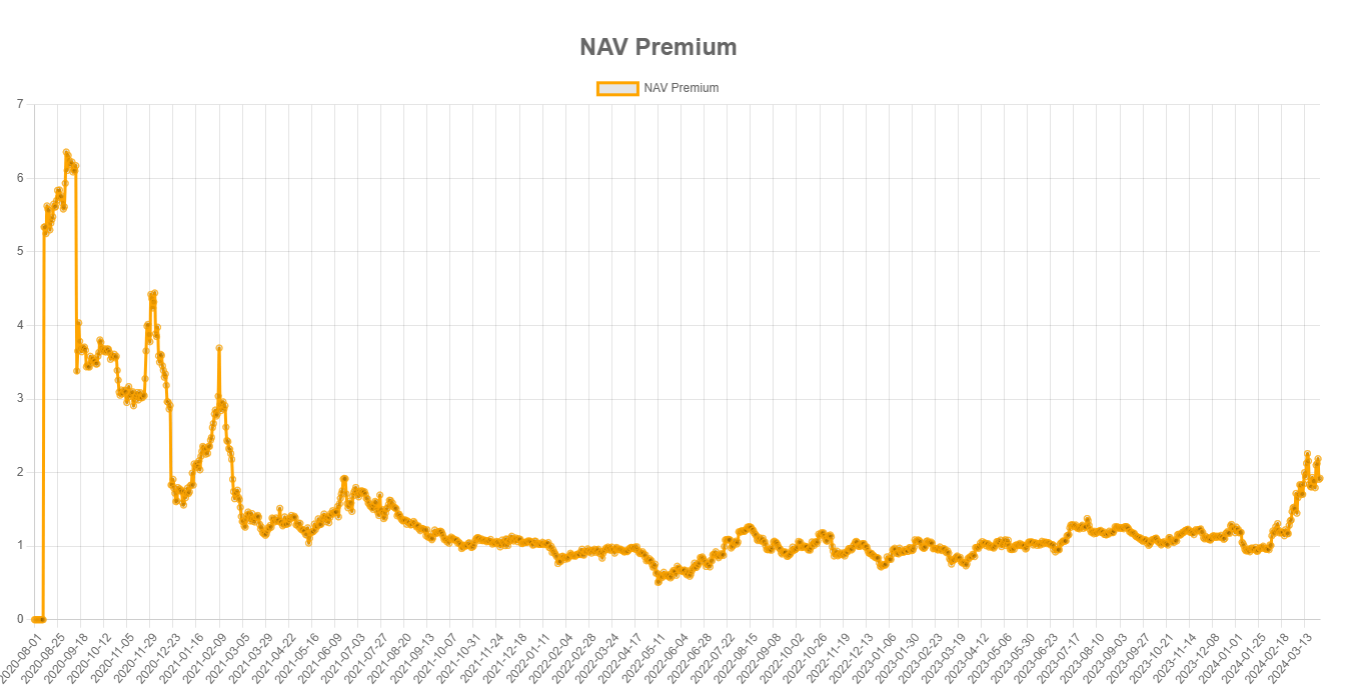

The “NAV Premium” chart, provided by mstr-tracker, which displays the premium of MicroStrategy’s stock over its proxy-NAV in Bitcoin, indicates that the market values the company’s stock at 1.92 times its Bitcoin holdings. The site has a unique methodology for defining an equivalent NAV for MicroStrategy, which considers its Bitcoin holdings, outstanding shares, share price, and market cap. Intriguingly, the current NAV figure matches the high observed in June 2021, when MSTR’s share price hovered around $500-$600, and Bitcoin traded at approximately $35,000.

The post Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11% appeared first on CryptoSlate.