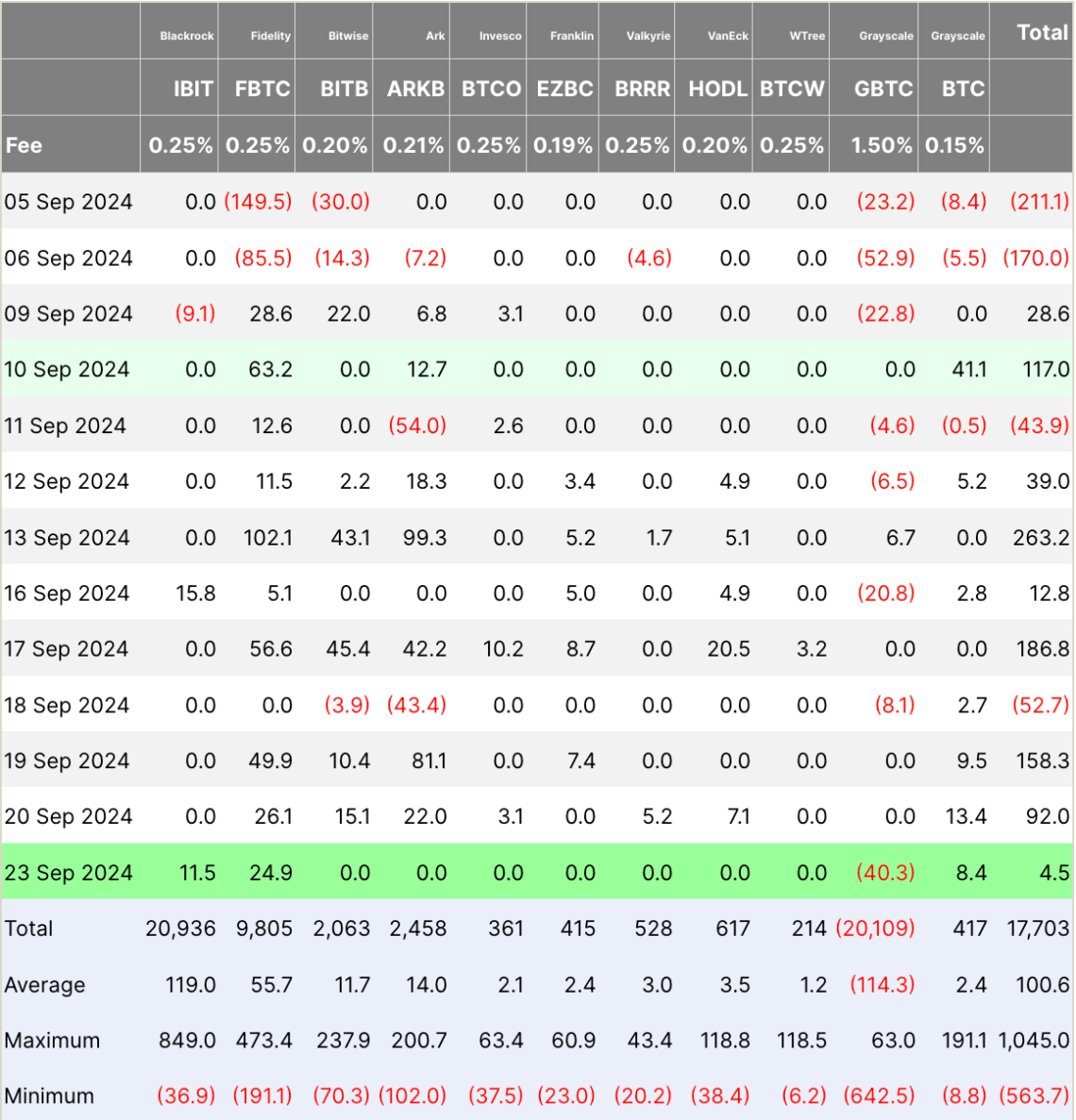

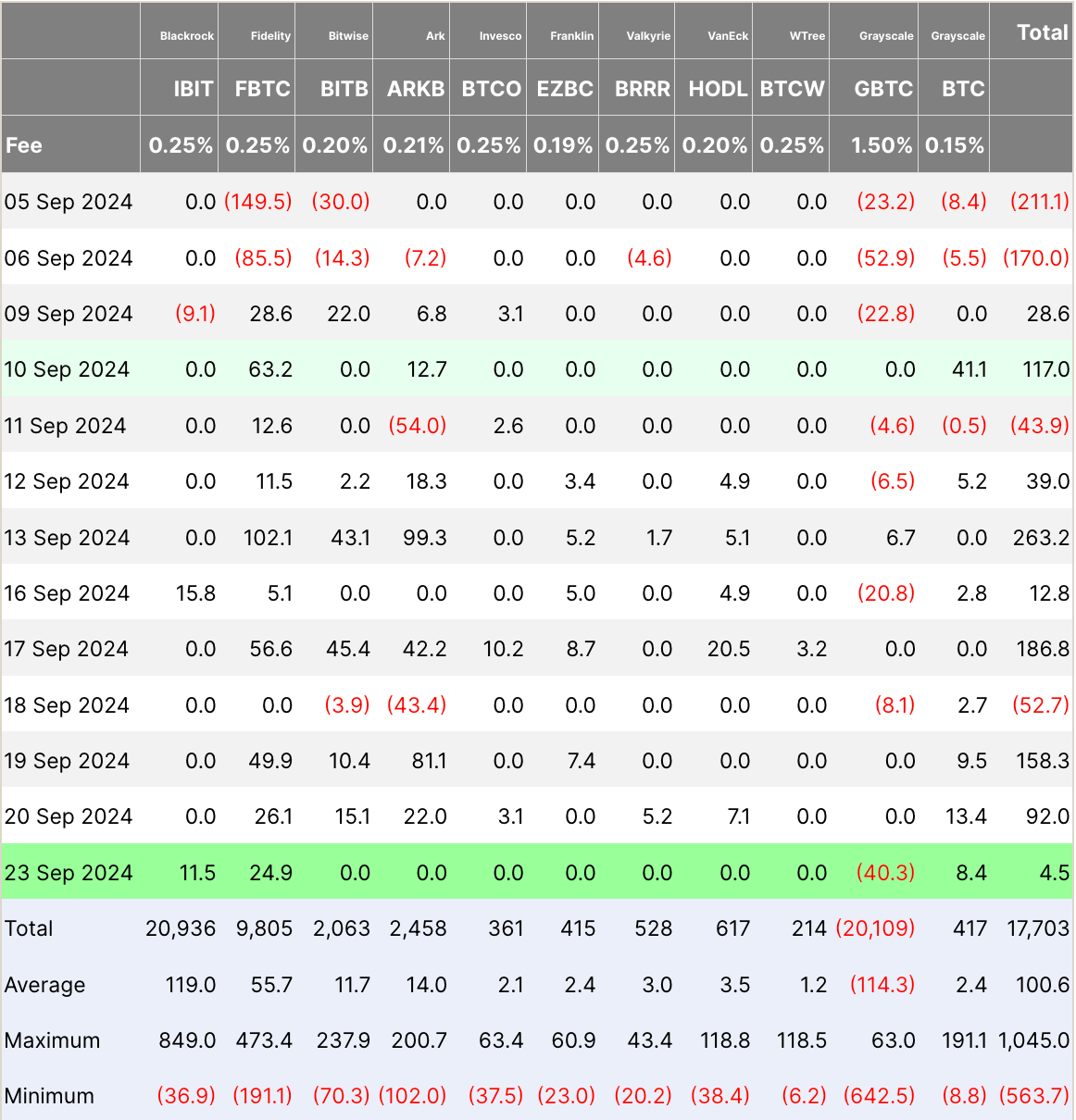

On Sep. 23, Bitcoin ETFs saw mixed flows, totaling $4.5 million. Fidelity’s FBTC ETF led inflows with $24.9 million, followed by BlackRock’s IBIT with $11.5 million. Grayscale’s smaller BTC fund also added $8.4 million. However, this was offset by significant outflows of $40.3 million from Grayscale’s GBTC, which remains one of the largest Bitcoin ETFs in the market. Other major funds, including Bitwise’s BITB, Ark’s ARKB, Invesco’s BTCO, and others, showed no activity, with flows remaining flat.

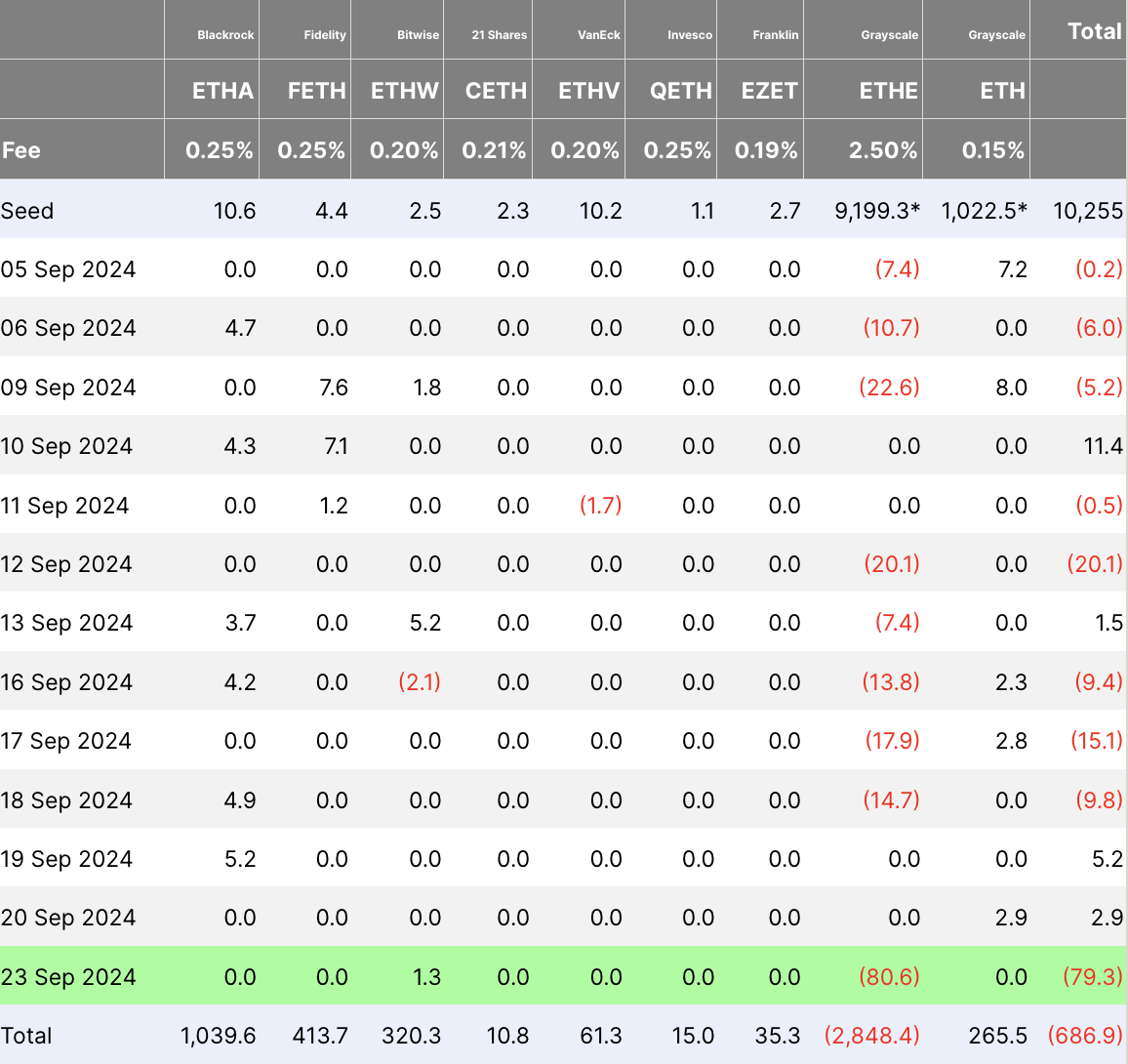

Ethereum ETFs experienced substantial net outflows, totaling a negative $79.3 million. Grayscale’s ETHE fund drove the bulk of the movement with significant outflows of $80.6 million, marking a sharp shift in investor sentiment. Bitwise’s ETHW was the only fund with inflows, recording $1.3 million, while all other Ethereum ETFs, including those from BlackRock, Fidelity, 21Shares, VanEck, Invesco, and Franklin, reported no inflows or outflows.

The contrasting flows spotlight ongoing volatility and selective investor participation. Bitcoin ETFs saw pockets of demand, while Ethereum ETFs, particularly Grayscale’s, faced pronounced withdrawals.