Quick Take

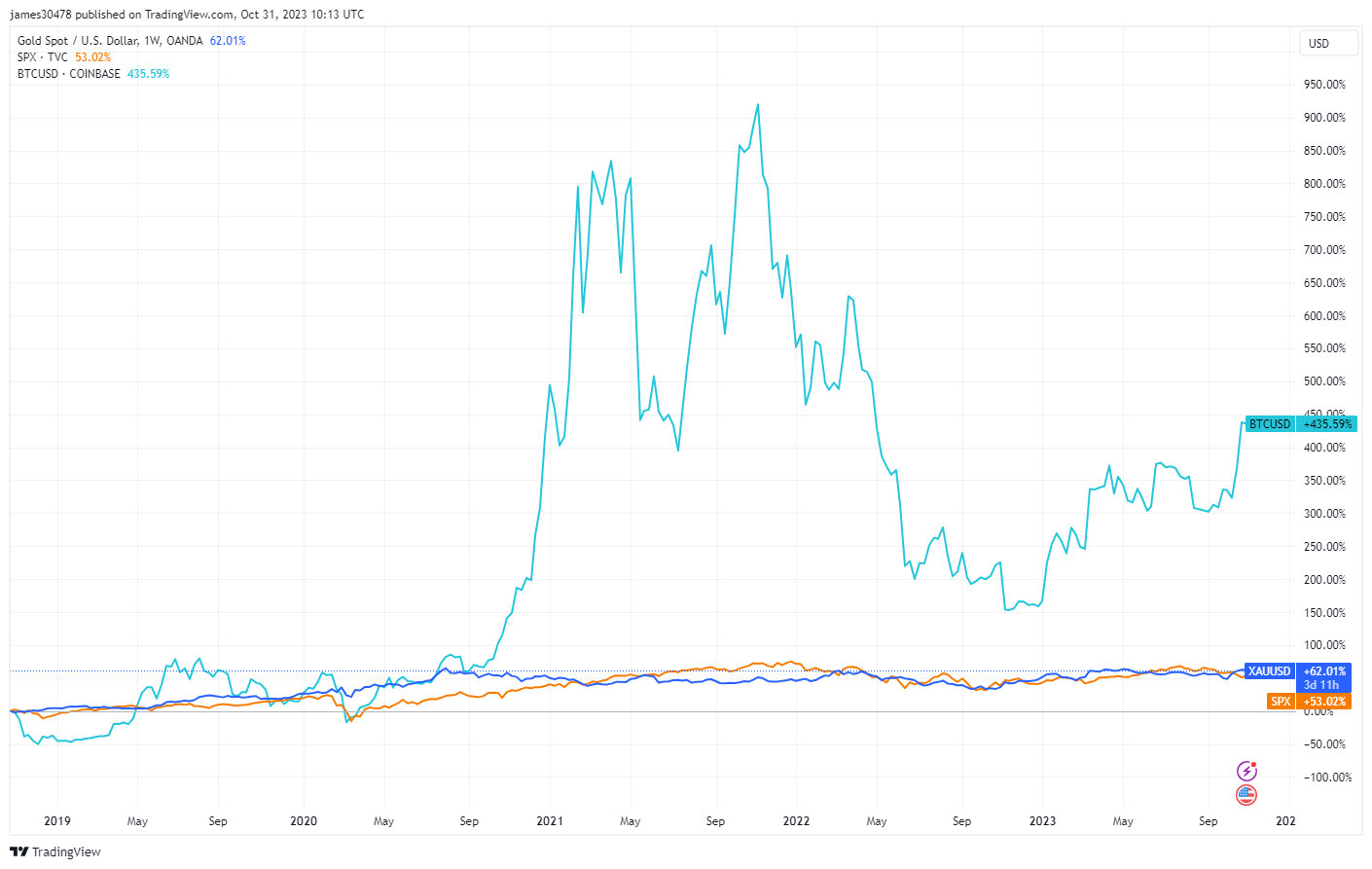

A compelling trend has emerged in the financial world, with gold recently closing above $2,000, a threshold it first surpassed earlier this year in April. Over the last five years, gold has consistently outperformed the S&P 500, delivering a return of 62% compared to the S&P’s 53%. Currently, both are recording year-to-date increases of approximately 8.5%.

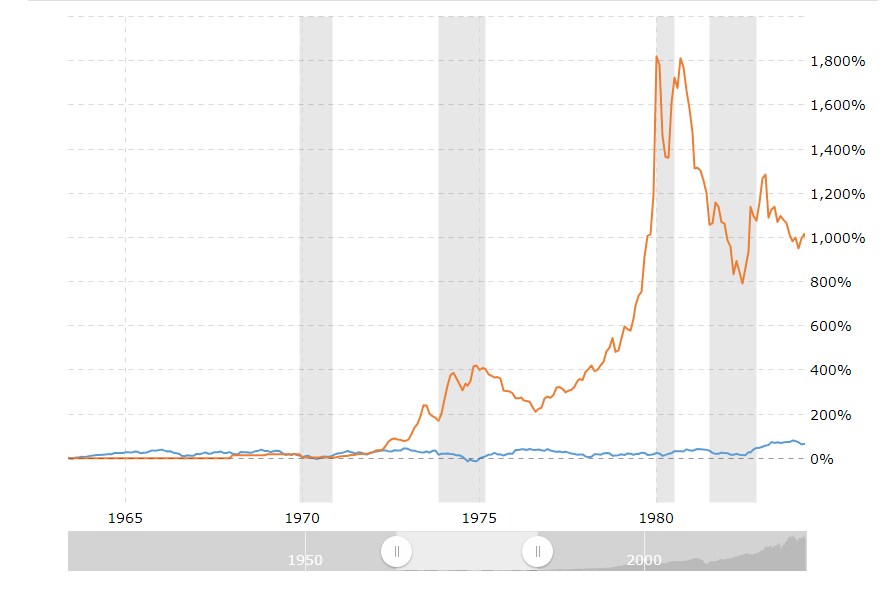

CryptoSlate’s analysis suggests that current market conditions are echoing patterns observed in the 1970s. Prior to that decade, the performances of gold and equities were closely matched.

However, in the inflationary environment of the 1970s, gold achieved unprecedented growth, surging over 1,000% and significantly outdoing equities. The recent performance of gold may signal a potential repeat of this historical trend, signifying important implications for investors and market dynamics.

Based on fundamental analysis, Bitcoin (BTC) has shown strong performance relative to gold, with an increase of over 100% year to date and a staggering 430% growth over the past five years. This raises the question of whether Bitcoin could potentially outperform gold in the same manner that gold outpaced equities in the 1970s.

The post Bitcoin vs. Gold: Mapping current trends onto historical data appeared first on CryptoSlate.

best antihistamine decongestant combo prescription medication for severe allergies prescription only allergy medication