December has been quite a month for Solana. The L1 blockchain has seen one of the fastest price recoveries this quarter, with SOL’s surge fueling the growing interest in its DeFi offering. CryptoSlate’s analysis of Solana’s on-chain found significant upward trends in almost all key metrics, indicating a period of robust growth and increased investor interest in the network.

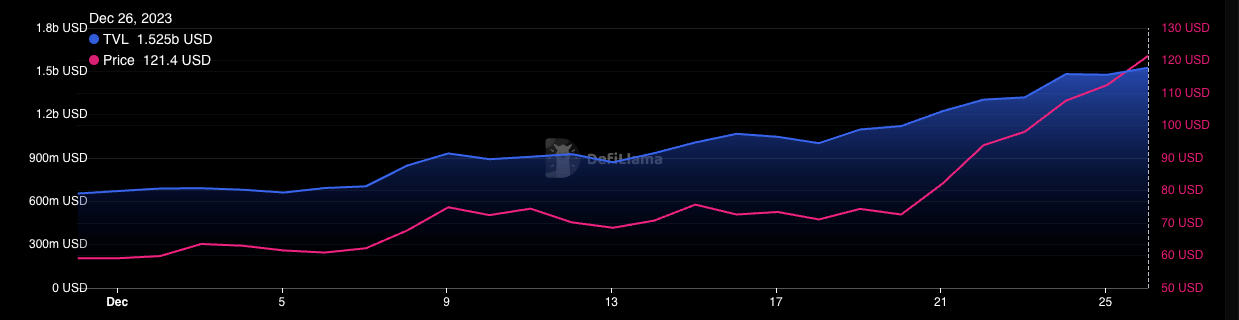

The total value locked (TVL) in Solana more than doubled from $671.62 million on Dec. 1 to $1.529 billion by Dec. 26. This substantial increase positions Solana as the 5th largest chain by TVL.

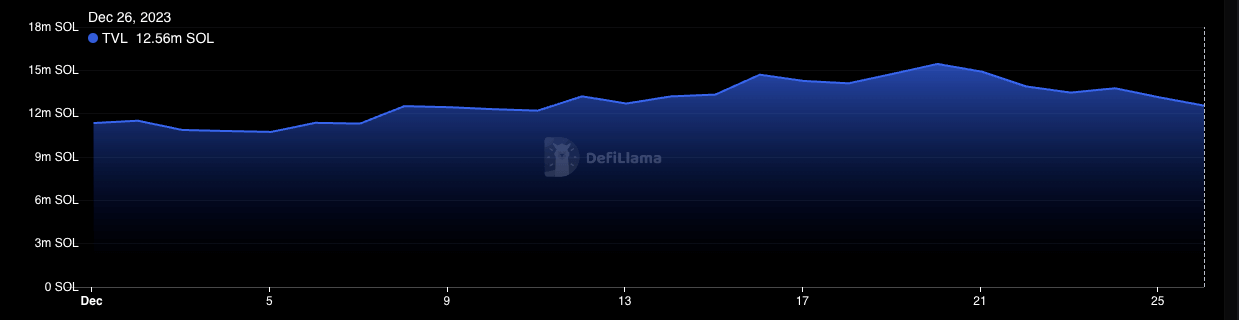

While the USD-denominated TVL showed a dramatic increase, the growth in Solana’s TVL when denominated in SOL was more modest, rising from 11.35 million SOL on Dec. 1 to 12.56 million SOL by Dec. 26. This discrepancy primarily reflects the impact of the SOL price on the valuation of the TVL. The SOL price increased significantly over this period, rising from $59.2 to $121.4. Consequently, the same amount of SOL locked in the network is worth considerably more in dollar terms, contributing to the sharp increase in USD-denominated TVL. This indicates that while there was growth in the amount of SOL being locked or staked, a large portion of the increase in the network’s value when measured in USD can be attributed to the rising price of SOL rather than an equivalent proportional increase in network utilization or investment.

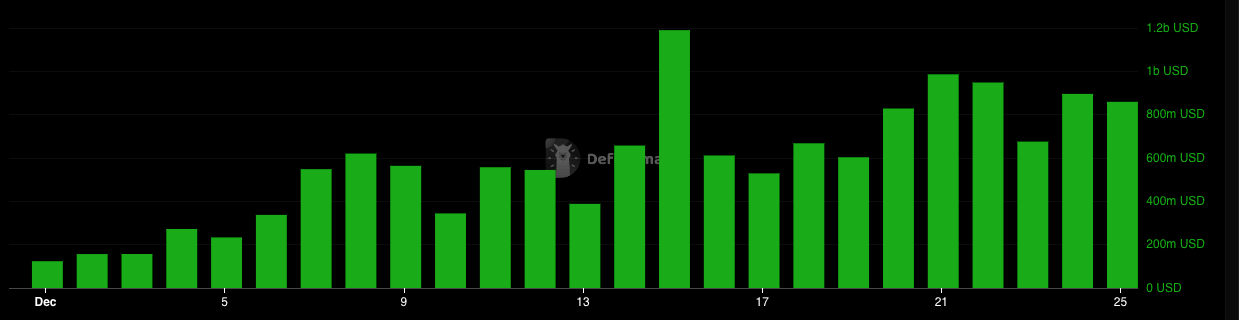

The trading volume on the Solana network saw notable fluctuations throughout December. The dollar-denominated volume increased dramatically, peaking at $1.19 billion in mid-December and then settling at $859.30 million by Dec. 26. The SOL-denominated volume followed a similar pattern, peaking at 15.73 million SOL on Dec. 15 before decreasing to 7.64 million SOL by Dec. 26. This trend could indicate a period of heightened trading activity, possibly driven by specific events within the Solana ecosystem or the broader crypto market.

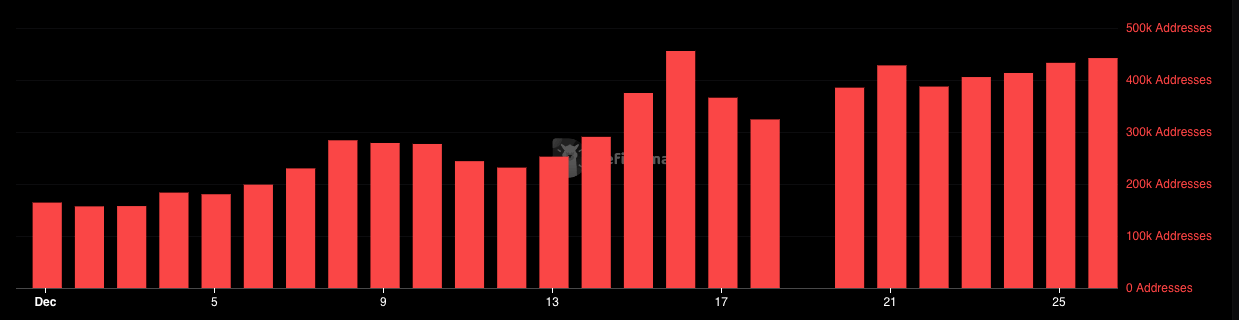

Additionally, there was a significant increase in the number of returning addresses, an important metric indicating user engagement and network utilization, saw a significant increase, growing from 164.19k to 442.16k. This growth suggests that more users are not only engaging with the Solana network but are also doing so repeatedly, which is a strong indicator of network health.

The significant rise in TVL, both in USD and SOL terms, alongside the notable increase in volume and returning addresses, shows a period of increased activity and interest in the Solana network. While the appreciation in SOL’s price has been a key driver in the perceived growth, the underlying on-chain metrics also reveal a more nuanced picture of gradual but steady engagement and investment in the ecosystem.

The post Solana’s holiday spirits high as it enjoys a booming December appeared first on CryptoSlate.