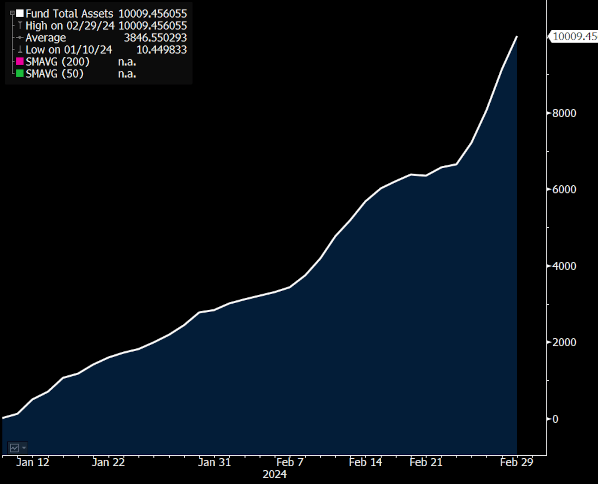

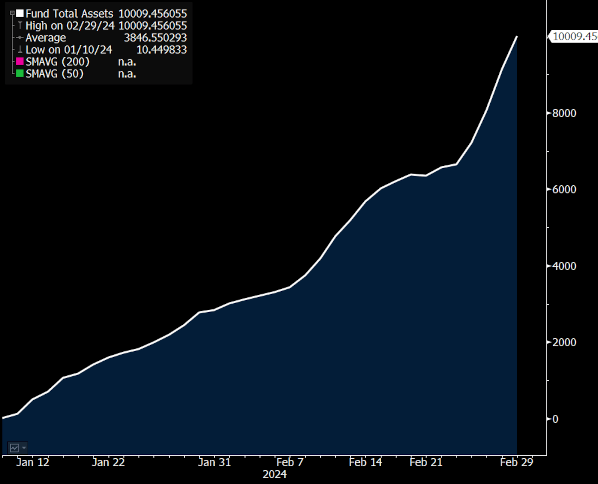

BlackRock’s iShares Bitcoin Trust (IBIT) now has more than $10 billion in assets under management (AUM), according to data from CoinGlass.

Bloomberg ETF analyst Eric Balchunas noted that IBIT is one of just 152 exchange-traded funds (ETFs) that have reached the $10 billion mark. Currently, roughly 3,400 ETFs exist in total.

He observed that IBIT is the fastest to reach $10 billion in AUM. The fund began trading less than two months ago on Jan. 11, meaning that it reached its current level in less than two months. ETF.com separately noted that the first gold ETF did not reach $10 billion in AUM for two years.

The competing Grayscale Bitcoin Trust (GBTC) reports a larger AUM, with $27 billion in assets under management. However, GBTC originated as an investment fund in 2013 before it was converted to an ETF this year, and unlike BlackRock’s IBIT, it did not start with zero assets.

The third largest spot Bitcoin ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC), now holds $6.5 billion in assets under management. All ten existing spot Bitcoin ETFs have $48.2 billion in AUM combined.

Reasons for IBIT’s growth

Balchunas implied that IBIT’s rising AUM is due to inflows. He suggested that ETFs typically struggle to achieve the first $10 billion in AUM because that value must originate from inflows, whereas the second $10 billion is easier to achieve because of market appreciation.

IBIT surpassed the $10 billion mark on March 1. Around that time, the ETF reported $7.7 billion in inflows since launch, including $603 million in inflows on Feb. 29. According to Balchunas, this makes IBIT the ETF with the third-longest run of inflows.

Rising Bitcoin prices may be an additional contributor to IBIT’s growth. As of March 4, Bitcoin is worth $67,200. Its price is up 25.3% over the past week and up 51.0% over two months.

Furthermore, certain financial institutions, including Bank of America’s Merrill Lynch and Wells Fargo, have reportedly begun to offer access to BlackRock’s Bitcoin ETF and competing exchange-traded funds. This development may have contributed to recent growth.