Onchain Highlights

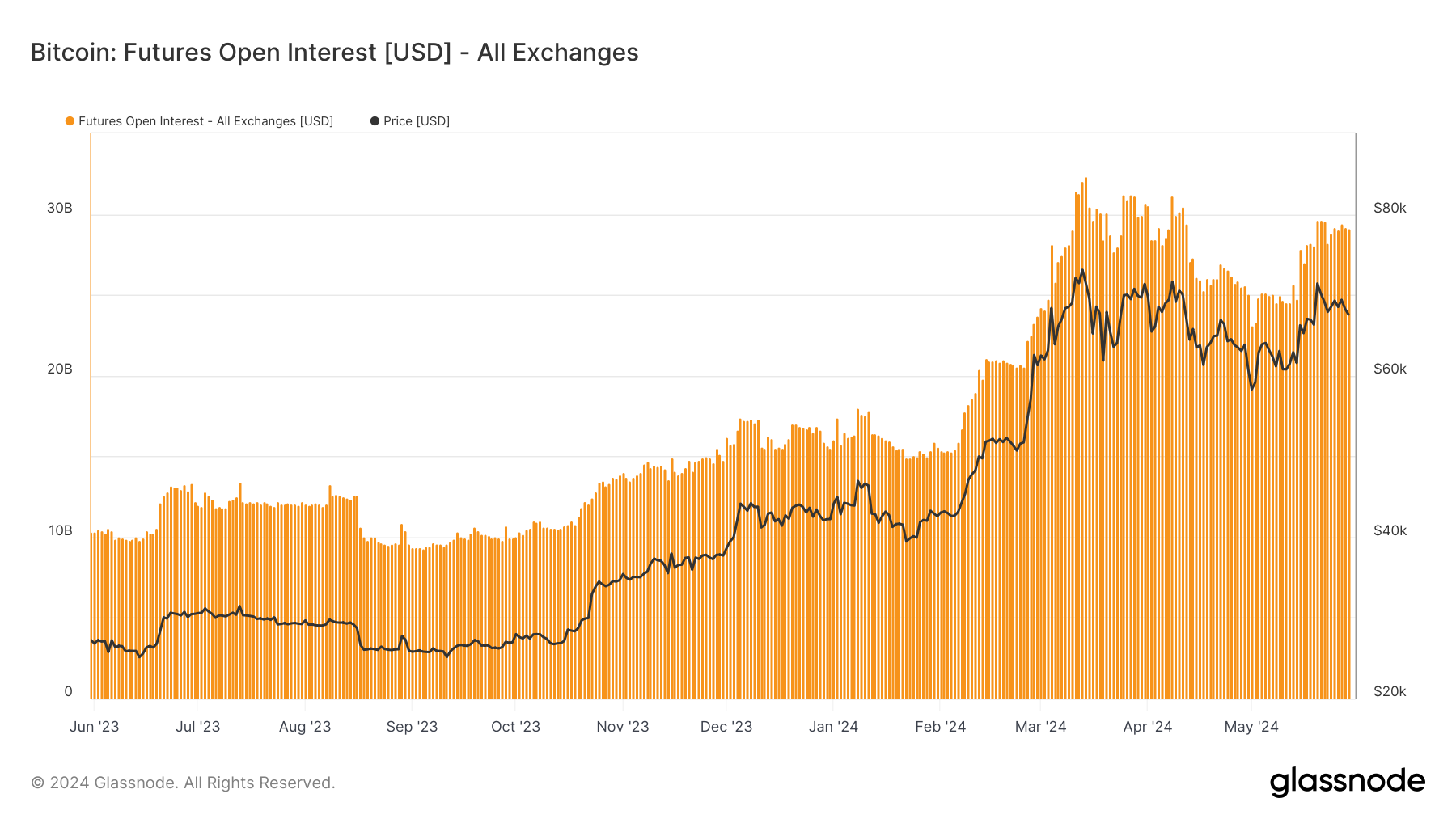

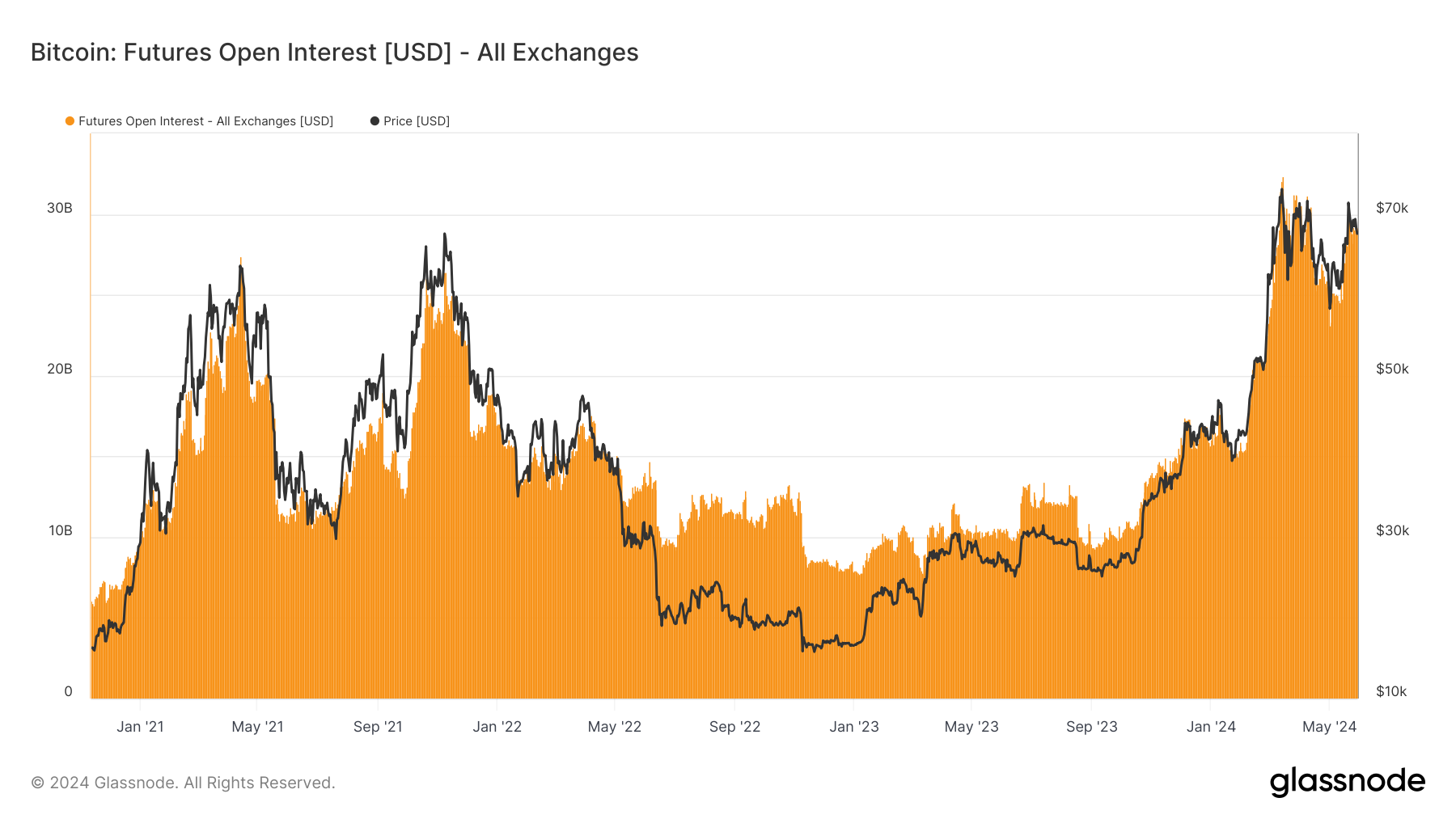

DEFINITION: Bitcoin futures open interest (OI) is the total amount of funds allocated in open futures contracts.

Bitcoin futures OI has seen a further rebound recently. As Bitcoin’s price approached $70,000 earlier this year, futures OI reached unprecedented levels, signaling renewed investor interest and market engagement. Past CryptoSlate insights highlighted that the uptick in OI reflects a significant rebound in the futures market, following a period of decline post-FTX collapse, which had erased 40% of open contracts.

As of now, approximately $29 billion is allocated in futures contracts, a marked recovery from the lows seen in late 2022 and close to highs set in March of this year. This resurgence is attributed to increased institutional participation, particularly through CME, which has become a key indicator of institutional interest in the market. The growth in futures OI not only highlights the renewed confidence among investors but also hints at potential market volatility and price movements as more leverage enters the market.

The post Institutional participation fuels Bitcoin futures resurgence appeared first on CryptoSlate.