In the past week, MakerDAO has experienced a drop in total value locked (TVL), the supply of DAI, and annualized fee income, signaling some potential trouble for one of the world’s largest stablecoin issuers.

Additionally, MKR’s value decreased by 25% during the same timeframe. Despite DAI’s recent return to parity with the US dollar, there is growing uncertainty about whether it will remain pegged, causing a decline in MakerDAO’s TVL over the last seven days.

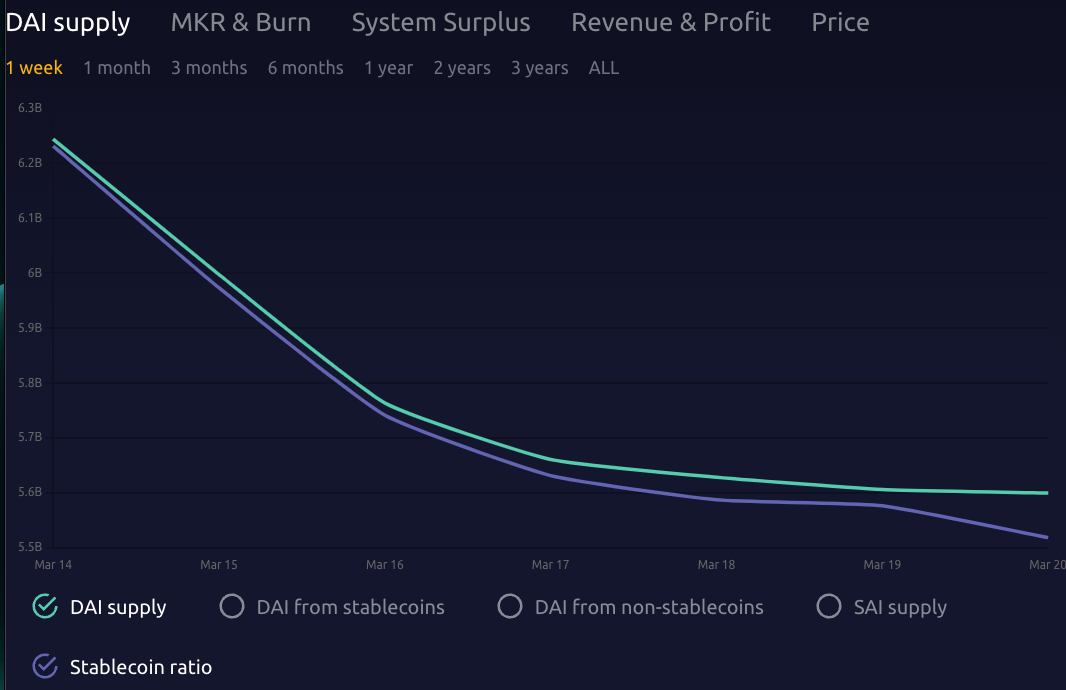

On-chain data suggests that MakerDAO’s decrease in asset value can be traced back to a reduction in collateralized loans on the platform. This drop in loans appears to be driven by concerns about the sustainability of the DAI stablecoin, which in the past week has seen a 13% decline in supply, per Marker Burn data.

Downward pressure on DAI

As a result, the supply of DAI also decreased, with Maker Burn data showing a 13% drop since March 13. Currently, the supply of DAI stablecoin is at 5.6 billion tokens. When the supply of DAI declines, it indicates a decrease in circulation, possibly due to a reduction in demand as observed in the past week, or due to a flight into other crypto assets, such as Bitcoin and Ethereum, both have which have surged in the past week.

What this potentially means for MakerDAO annualized income spreads

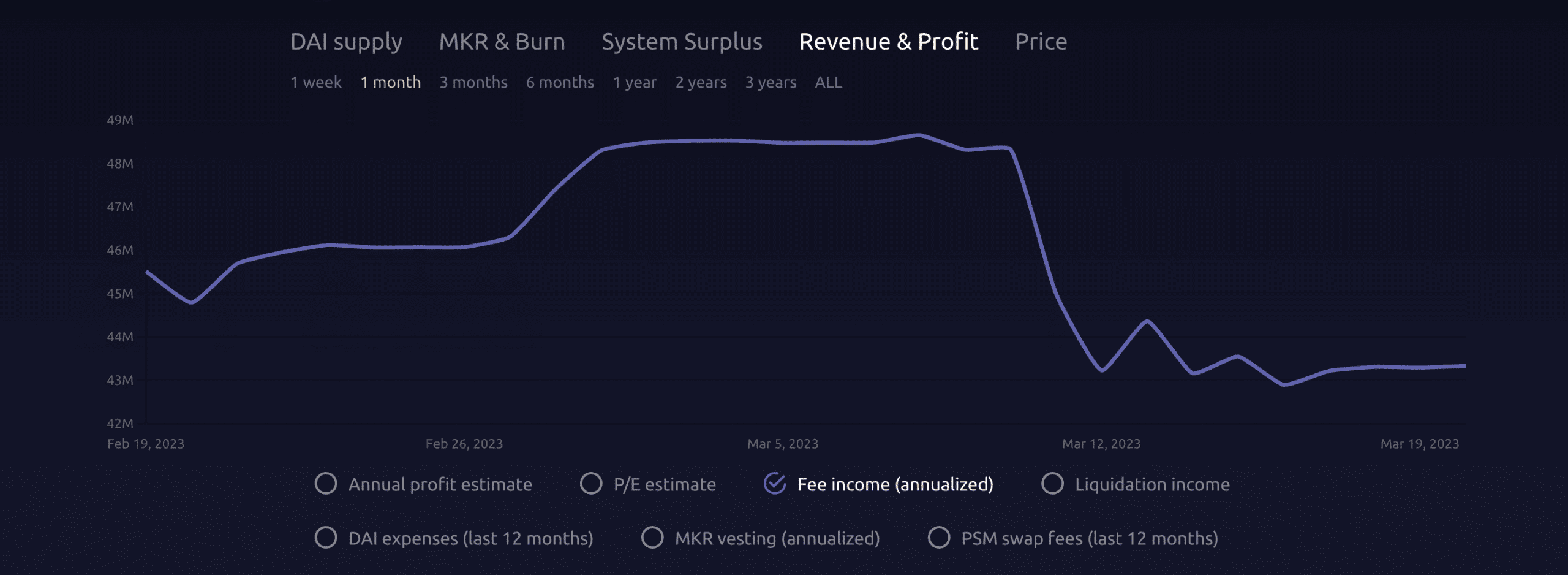

The decrease in DAI’s supply over the past week has led to a decline in MakerDAO’s annualized fee income. MakerDAO generates income through fees when users open a Collateralized Debt Position (CDP) and generate DAI, which is then paid in MKR tokens.

As the stability fee is paid in DAI and converted to MKR, a decrease in DAI supply can lead to a reduction in stability fees and, subsequently, a decline in the amount of MKR tokens distributed as fee income. Maker Burn data indicates that since the collapse of Silicon Valley Bank, MakerDAO’s annualized fee income has decreased by 10%.

As DAI and other stablecoins decrease, Tether increases

According to data from CryptoSlate, Tether’s USDT supply has reached 74 billion for the first time since May 2022.

Over the last month, Tether’s supply has increased by approximately 5 billion due to regulatory scrutiny and banking issues faced by its stablecoin competitors, such as BUSD and USDC.

In contrast, USDC, BUSD, and DAI supplies have decreased this year, while USDT’s supply has grown by 10%, with USDT’s market dominance reaching 56.4% last week, its highest point since July 2021.