Bitcoin options markets continue to signal near-term risks to BTC price, despite strategists warning that Wednesday’s Fed meeting could start a “bloodbath” in the cryptocurrency markets.

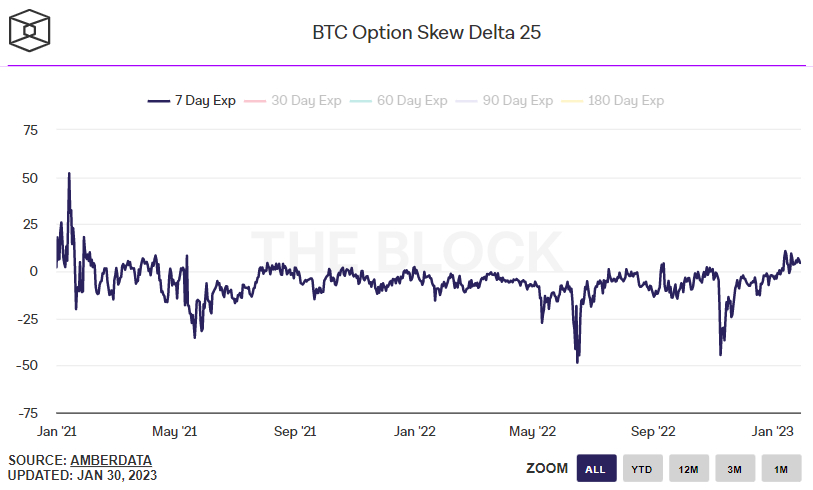

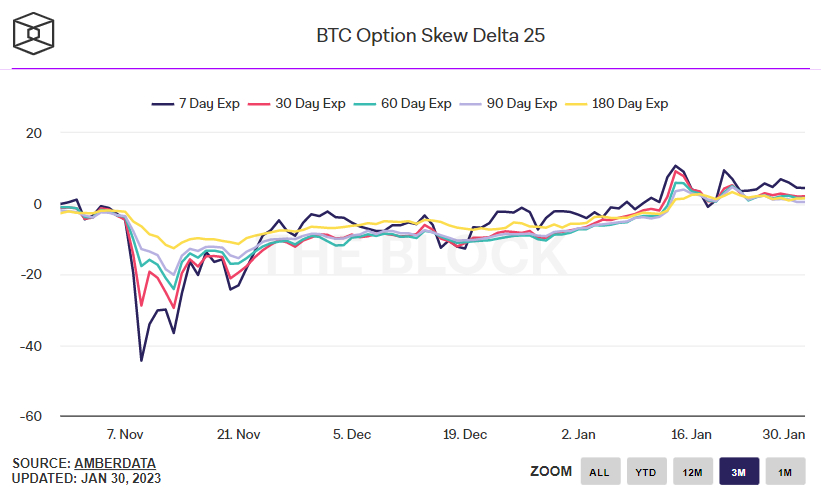

According to a chart on The Block, a widely followed 25% delta skew Bitcoin Options expiring in seven days remain at 4.44 on 30th January’s, not far below the recent multi-year high in the 9.0 area earlier this month. skew of 25% delta Bitcoin Options expiring in 30, 60, 90 and 180 days all traded between 0.5 and 2.0, indicating more of a neutral market bias, though all also remained close to multi-month highs.

The 25% delta option skew is a popular monitored proxy of the extent to which trading desks are charging investors more or less for the upside or downside protection through put and call options being sold. A put option gives an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta option skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies that demand for calls versus puts is higher, which can be interpreted as a bullish sign as investors are more eager to hedge (or bet) a security against a rise in prices.

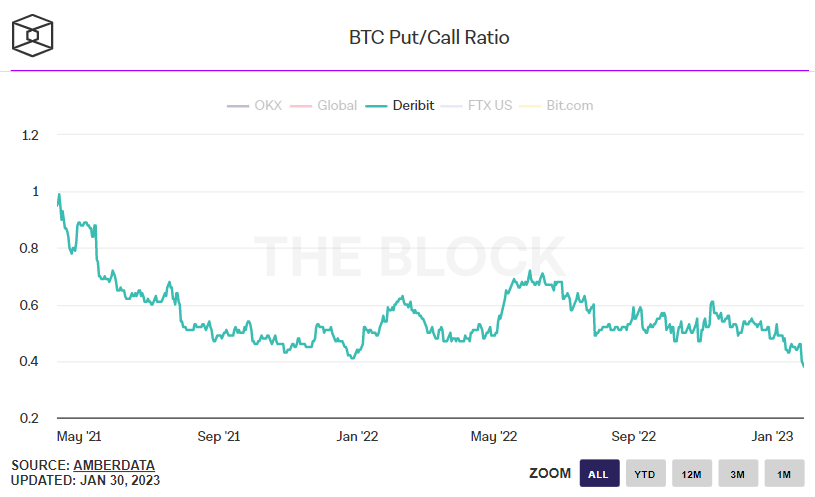

elsewhere, the Bitcoin Open interest Put/Call ratio on leading crypto derivatives exchange Deribit on 29th In January it slipped to a new record low of 0.38. This means that investors are favoring call options (betting on falling prices) over put options (betting on falling prices) by a record margin.

Fed Meeting Could Trigger Crypto “Blood”

The Fed is widely expected to raise interest rates by 25 bps on Wednesday, taking the federal funds target range to 4.50-4.75%. Thus a 25 bps rate hike would not be a surprise and should not move the markets at all. What matters to the markets is the outlook for interest rates.

More specifically, by how much more will rates increase? And how long will interest rates remain at the restrictive terminal rate? It appears that after the market Wednesday’s hike, the Fed will raise interest rates only once (in March) by 25 bps and then start cutting interest rates in late 2023.

This seems to be based on the condition that 1) US inflation (price and wage pressures) will continue to fall back towards the Fed’s 2.0% target and 2) the US will enter a recession later this year – which means the Fed will will have the space and willingness to start cutting interest rates to support the economy.

But strategists are warning that markets are underestimating the Fed’s resolve to raise interest rates and keep them at restrictive levels for an extended period of time. According to the popular pseudonymous macro-focused Twitter account The Carter, the Goldman Sachs US Financial Conditions Index (FCI) is now at its lowest level since September 2022.

Carter felt that, as a result, “there will be blood on February 1st”, with Fed Chairman Jerome Powell addressing financial conditions forcefully by “cutting rates (i.e. betting on rate cuts) … head-on”. To tighten with.

“Pavel Fed burns Fed is laser-focused on “prematurely easy” policy to avoid “stop and go” error,” Carter added. “Mere talk of rate cuts anathema” Fed’s comprehensive tightening project for .

A violent upward reappraisal of the Fed’s interest rate intentions in the coming year (perhaps forcing market interest rates to move up and stay above 5.0% for the rest of the year) would lead to a big move in the US dollar, US bonds . The returns and declines in assets such as stocks, gold and crypto.

But options markets don’t seem worried about potential volatility

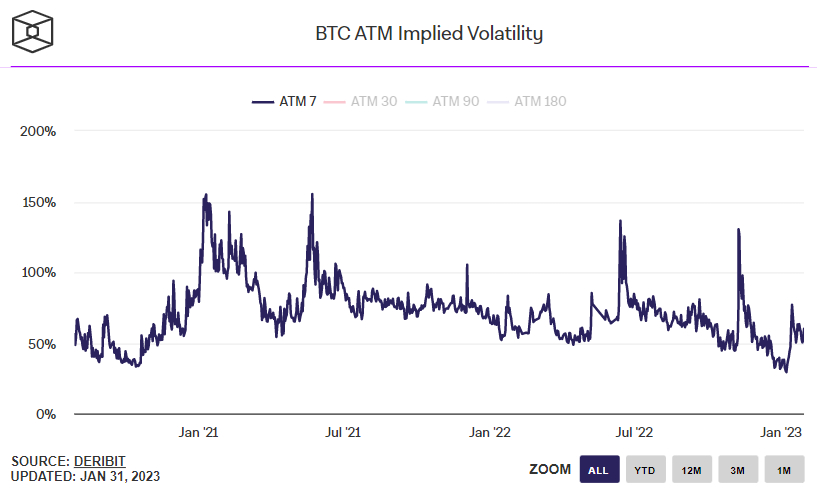

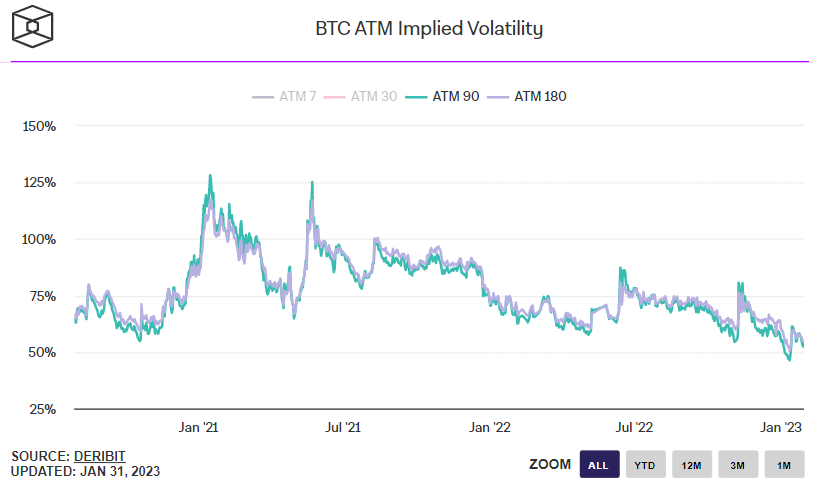

Despite dire warnings of an imminent possible pullback in B T c Price, options markets also don’t seem worried about the increase in volatility. Implied volatility of options expiring in seven days’ time at the money (ATM) was about 60%, roughly where it has been since mid-January and still below its average level for 2022 and 2021, though still That’s up significantly from its record low of less than 30% earlier this month.

Options expiring in both 90 and 180 days’ time indicate that expectations about bitcoin’s long-term volatility are nearing record lows.

This may be because, despite the risk of an auction by the Fed this week, bitcoin investors are growing more confident that the bear market of 2022 is over. as recently covered ArticleSix of the eight indicators looked at by analysts on crypto data analytics platform Glassnode to identify when bitcoin is breaking out of a bear market are flashing bullish signs, and the seventh is likely to turn green soon as well.

types of allergy pills allergy medications prescription list allergy pills non drowsy