A Glassnode on-chain indicator of Bitcoin HODLer conviction called “Reserve Risk” recently fell to its all-time low, indicating that HODLer conviction is at an all-time high. In the wake of the collapse of FTX, formerly one of the world’s largest centralized cryptocurrency exchanges, Bitcoin The Reserve Risk Indicator fell to a new record low of 0.000729. It has since recovered to around 0.0010.

According to Glassnode, Reserve Risk is used to “assess the confidence of long-term holders relative to the price of the native coin at any given time”. Reserve risk is “a long-term cyclical oscillator that models the ratio between the current price (incentive to sell) and long-term investor conviction (the opportunity cost of not selling)”.

The conviction of long-term investors lies in Glassnode’s “HODL Bank” index, which represents the accumulation of unspent “opportunity costs” accrued by HODLers when they decline to sell. Reserve risk is defined as the current Bitcoin Market value divided by HODL Bank Index score.

Glassnode says that when confidence is high and the price of BTC is low (meaning the Reserve Risk Score is low), the risk/reward of investing in it is Bitcoin is attractive. Meanwhile, in the opposite scenario when confidence is low and prices are high (meaning a high risk reserve score), the risk/reward is unattractive.

According to one crypto analyst who recently commented on a number of bullish on-chain indicators including the Risk Reserve Indicator, “confidence among long-term bitcoin holders doesn’t get much better than this”.

What does the recent risk reserve bounce mean for BTC price?

In light of the recent rally in the price of bitcoin, the Risk Reserve score has naturally gone up. Historically, this has coincided with the start of new bitcoin bull markets after the Risk Reserve indicator bottomed out. At least, that seems to have been the case in late 2020, 2019, 2015, and 2011.

If history is anything to go by, Risk Reserve is thus indicating that the coming few years could see an uptick in the price of bitcoin. The Risk Reserve indicator can also be added to the list of others that flash bullish long term buy signals.

crypto quant The Profit and Loss (PnL) Index, an index constructed from three on-chain indicators related to the profitability of the bitcoin market, recently moved back below its 365-day Simple Moving Average (SMA) after a long period. “The CQ PnL index has given a definite buy signal for BTC,” CryptoQuant notes, before adding that “the index crossover implied the start of a bull market in previous cycles”.

Meanwhile, as discussed in a recent article, a growing confluence of indicators (Looking at eight pricing models, network usage, market profitability and balance of money signals) tracked in Glassnode’s “Bitcoin Recovering from Bears” dashboard, suggesting that bitcoin is in the early stages of recovering from a bear market. Maybe in.

Elsewhere, an analysis of bitcoin’s long-term market cycles also suggests that the world’s largest cryptocurrency by market capitalization may be in the early stages of a nearly three-year bull market. According to an analysis by crypto-focused Twitter account @CryptoHornHairs, bitcoin is roughly following the path of a four-year market cycle, which has been fully respected for eight years now.

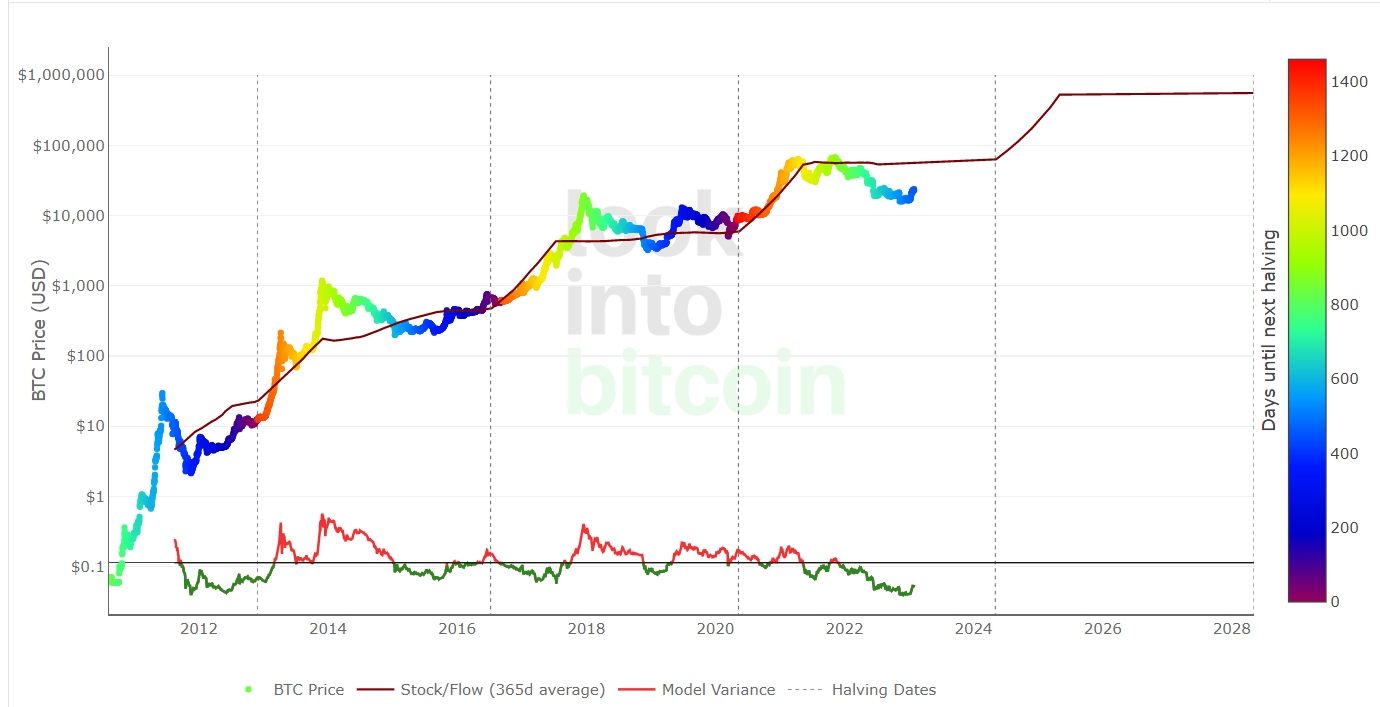

Additionally, a widely followed bitcoin pricing model is telling a similar story. According to the bitcoin stock-to-flow pricing model, the bitcoin market cycle is roughly four years, with prices typically bottoming out somewhere between four-year intervals between “halvings” — bitcoin halvings occur every four years. The year is the event where the mining reward is halved, thus slowing the rate of bitcoin inflation. Past price history suggests that the next big rally for bitcoin will come after the next halving in 2024.

But first… macro risk

Optimism that bitcoin has bottomed out has grown significantly since the start of the year, not least amid bitcoin’s nearly 40% price rally. But traders have a big week of macro events, many of which are likely to trigger short-term volatility, to navigate before declaring victory that the new bull market is here.

the feds issue it latest policy announcement on Wednesday before the ECB and BOE on Thursday, and on Friday before the release of the official January US jobs report. The US ISM PMI survey and this week’s JOLT data will also be worth watching, as will earnings from US tech behemoths.

Will the Fed Make a Bad Bullish Party?

The main event will of course be the Fed meeting. The US central bank is widely expected to raise interest rates by 25 bps on Wednesday, hitting the federal funds target range of 4.50-4.75%. Thus a 25 bps rate hike would not be a surprise and should not move the markets at all. What matters to the markets is the outlook for interest rates.

More specifically, by how much more will rates increase? And how long will interest rates remain at the restrictive terminal rate? It appears that after the market Wednesday’s hike, the Fed will raise interest rates only once (in March) by 25 bps and then start cutting interest rates in late 2023.

This seems to be based on the condition that 1) US inflation (price and wage pressures) will continue to fall back towards the Fed’s 2.0% target and 2) the US will enter a recession later this year – which means the Fed will will have the space and willingness to start cutting interest rates to support the economy.

But strategists are warning that markets are underestimating the Fed’s resolve to raise interest rates and keep them at restrictive levels for an extended period of time. According to the popular pseudonymous macro-focused Twitter account The Carter, the Goldman Sachs US Financial Conditions Index (FCI) is now at its lowest level since September 2022.

Carter felt that, as a result, “there will be blood on February 1st”, with Fed Chairman Jerome Powell addressing financial conditions forcefully by “cutting rates (i.e. betting on rate cuts) … head-on”. To tighten with. At least (possible drop of 10%?)

Other strategists agree. Nauman Sheikh, head of treasury at crypto asset management company Wave Financial, commented to the crypto press that “there is a strong possibility that at the press conference, Powell will be more aggressive and tighten financial conditions again”. “For this reason, we may see a healthy short-term correction in crypto and all risk assets,” he said.

Meanwhile, Chris Weston, head of research at Pepperstone, warned that financial conditions have eased enough that Fed Chairman Jerome Powell may want to label the extent of easing as “unwarranted”. Weston thinks this will reduce riskier assets like tech stocks and crypto.

but as mentioned a recent article, the bitcoin options market continues to show a bias towards investor positions in anticipation of further upside in the short to medium term. Maybe they’re on the wrong foot.

does benadryl make you sweat types of allergy pills strongest otc allergy med