Bitcoin has seen a significant drop in its price over the past few days, leading investors to wonder whether now is the time to buy the dip. Bitcoin It is trading within a narrow range of $22,700 to $23,850, and a breakout will determine future price action in the market.

In this article, we will explore what could be causing this pullback and whether or not it is a good time to invest in bitcoin.

Tesla’s $140M Bitcoin Loss and What You Need to Know About It

Tesla disclosed in his SEC filing This Monday he experienced a financial loss due to the amount he invested in bitcoin – which totaled over $140 million. During 2022, the electric car company incurred a loss of $204 million in terms of impairment charges. However, they also managed to get $64 million due to converting to bitcoin.

In December 2022, Tesla reported a loss of $204 million due to changes in the value of its bitcoins. Additionally, he experienced a profit of $64 million on converting bitcoin to fiat currency. This was detailed in their filing document.

An impairment charge occurs when the value of a particular asset is reduced or completely lost. This could happen due to unexpected changes in the economy, like what happened to the crypto market when Terra Luna failed in May 2022.

Tesla’s latest SEC disclosure revealed a $43 million loss on his bitcoin holdings in the last four months of 2022. This follows the release of their quarterly earnings report, which showed no evidence of any bitcoin transactions.

According to an SEC filing, Tesla booked $101 million in impairment losses on digital assets in 2021. In the same year, he also made a profit of $128 million after selling bitcoins. This was almost double the loss from the previous year.

As of October 2022, Tesla told its investors that it still retained $218 million in bitcoin after selling 75% back in July, which was worth about $936 million at the time.

The latest earnings report and SEC filing did not list any digital assets other than bitcoin. However, rumors suggest that the company owns Dogecoin as they accept it as payment and CEO Elon Musk has publicly shown his support for it.

Since Tesla is still holding bitcoin, it is boosting investor confidence and could keep the BTC price supported.

German Banking Giant to Offer Bitcoin and Crypto Services

Decabank, a German financial institution with over a century of experience and $428 billion in assets under management, has entered into an agreement with? Metaco will start offering digital assets For Corporate Customers.

According to a press statement issued on January 31, Decabank will use Metaco’s Harmonize platform for operations such as custody and orchestration. Decabank will be able to manage their digital asset operations with the help of Metaco’s Custody Platform, which is a key portal for them.

After an extensive selection process and proof of concept, the bank went ahead with the partnership. The process was comprehensive to ensure that he made an informed decision.

Decabank, a German banking and financial services provider, is partnering with Metaco, a Swiss-based firm focused on cryptocurrency solutions. It is the support of the industry that will help Decabank expand its range of products to include crypto-related services for its institutional customers.

Institutional investors such as pension funds have to adhere to stringent regulatory guidelines that restrict their direct investment in cryptocurrencies such as bitcoin. This is in contrast to retail customers, who have more flexibility when it comes to investment options.

bitcoin price

Currently, the price of Bitcoin $23,158 and is up more than 1% in the last 24 hours. Its market volume is estimated at $22 billion, while its market cap is an impressive $445 billion and it ranks first in CoinMarketCap’s ranking.

The BTC/USD pair struggled to overcome the $24,000 barrier on the 4-hours chart and has since declined to assess the $23,000 support.

If bitcoin price declines from the current levels, it could decline towards $22,600 or $22,350. A support at $23,000 has formed based on the 50-day moving average on the 4-hour time frame. A break of this price level could see a bullish reversal in the BTC/USD pair.

It is profitable to enter buy positions above $23,000 with a target price of $23,550 or $24,000. On the other hand, if there is a break above the $23,000 support area, sell positions could be a better option.

bitcoin options

Cryptonews recently released a list of the cryptocurrencies most likely to succeed in 2023. If you are interested in investing, there are many other great investments that can potentially give you good returns if researched properly.

Crypto investors and traders keep a close eye on altcoins and upcoming ICOs in the digital asset space to ensure they don’t miss any promising trends or potential investment opportunities.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

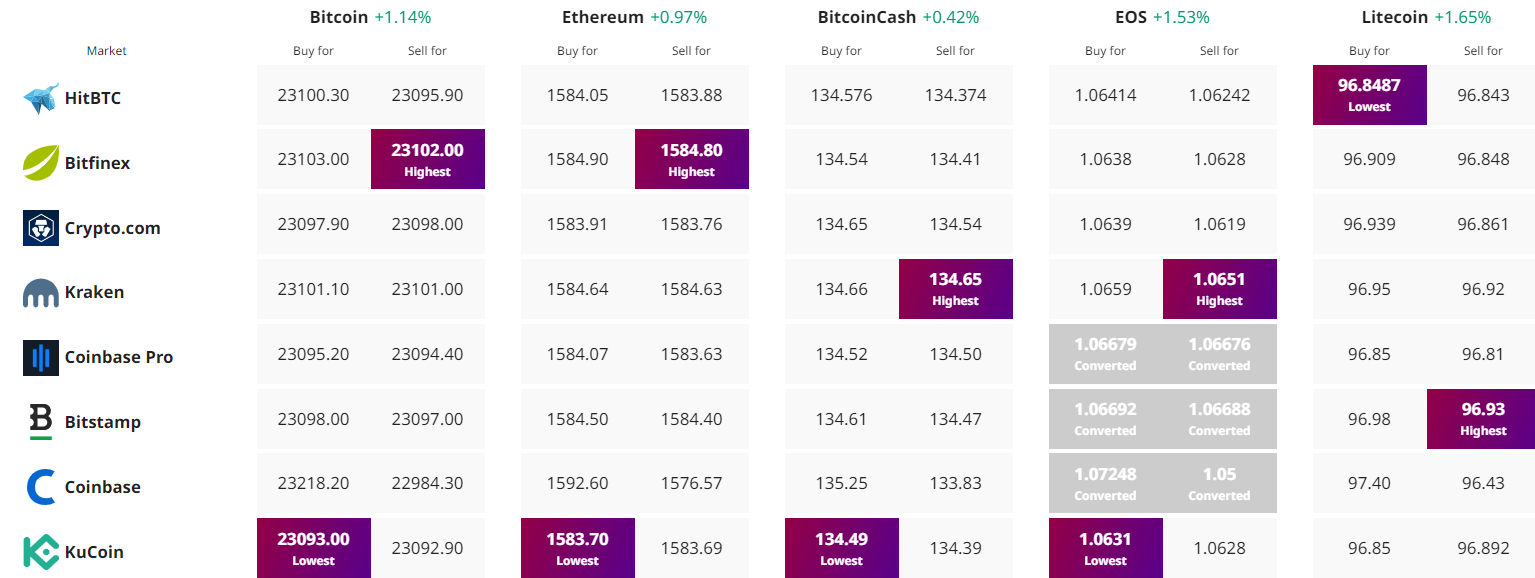

Find the best price to buy/sell cryptocurrency