As the Federal Reserve announces its interest rate decision, many investors are looking to the future Bitcoin And asking: Can BTC hit $30,000 this month?

The Federal Reserve announced on Wednesday that it would raise its key short-term interest rate by a quarter point, down from a previous 0.5-point increase in December. This decision showed that inflation is not as high as it was earlier and is declining.

After their two-day meeting, the Federal Reserve reported that inflation had eased slightly but was still relatively high. The central bank appears reluctant to indicate that their efforts to combat inflation are falling short, even as they weigh the benefits of the initiative against growing recessionary risks.

Bitcoin has experienced a significant decline in value over the past few days, leading investors to ask whether it is currently the best time to buy this cryptocurrency. Currently, bitcoin is trading within a range of $22,700 – $23,850 and an outcome in this range will indicate how the market may react.

In this article, we will take a look at the possible reasons behind the recent drop in bitcoin price and analyze whether it is a viable investment option at this time.

US Government Releases Blacklist of Bitcoin and Ether Addresses Linked to Attempts to Evade Sanctions

OFAC, the US Treasury Department’s watchdog for sanctions compliance, has placed one bitcoin and one ethereum address on its “blacklist” because it believes these addresses have been used to evade sanctions.

a Press release It was revealed that Igor Zimenkov and his son Jonathan were part of a vast network of people and organizations attempting to export defense technology overseas. A Russian national, Jonathan Zimenkov, was linked to two addresses linked to both his father and Rosoboronexport OAO.

Rosoboronexport is a Russian state intermediary that deals with arms exports, according to the company’s website. according to a Press release From the Office of Foreign Assets Control (OFAC), Igor and Jonathan Zimenkov were in direct contact with organizations that are subject to economic sanctions from Russia.

Rosoboronexport has conducted a number of transactions related to Russian cyber security and helicopter sales to foreign countries, and has personally negotiated with potential customers to facilitate the sale of Russian military equipment.

At the time of writing, neither bitcoin nor ether had any digital currency in the address. The bitcoin address, which held no more than 0.01 BTC (worth about $230 at the time), was last used in December 2022. This specific Ethereum address has seen substantial amounts of ETH move in or out in the past, but has had almost no activity for a year.

Last November, an ether address received funds from an address identified by Arkham Intelligence as a wallet actively involved in over-the-counter (OTC) trading. This is very interesting to note. Alameda Research, the trading firm founded by FTX originator Sam Bankman-Fried, previously transferred funds to that address.

bitcoin price

yet, the value of Bitcoin stands at $23,052.37 with a daily trading volume of $22 billion. It has seen a decline of 0.33% in the last 24 hours. It currently holds the top position on CoinMarketCap and has a market capitalization of $444 billion.

The 4-hour BTC/USD exchange rate chart is recently having difficulty above the $24,000 barrier. It has since declined to test the $23,000 support.

According to the 50-day moving average on the 4-hour time frame, support at $23,000 has been established for bitcoin price. If there is a break below this level, it could potentially decline towards $22,600 or even lower below $22,350. It could also trigger a bullish reversal in the BTC/USD pair.

Investing in buy positions with prices above 23,000 and a target of 23,550 or 24,000 can be considered profitable. However, sell positions can turn profitable if the price declines below the $23,000 support area.

bitcoin options

Cryptonews recently released a list of the most potential crypto investments that can make you handsome returns in 2023. If you are considering investing, it is important to do your research carefully and look for other great options that can generate higher returns.

Crypto enthusiasts are always on the lookout for the latest news and trends in the digital asset space in order to identify any potential opportunities they may want to invest in. They stay ahead of the curve.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

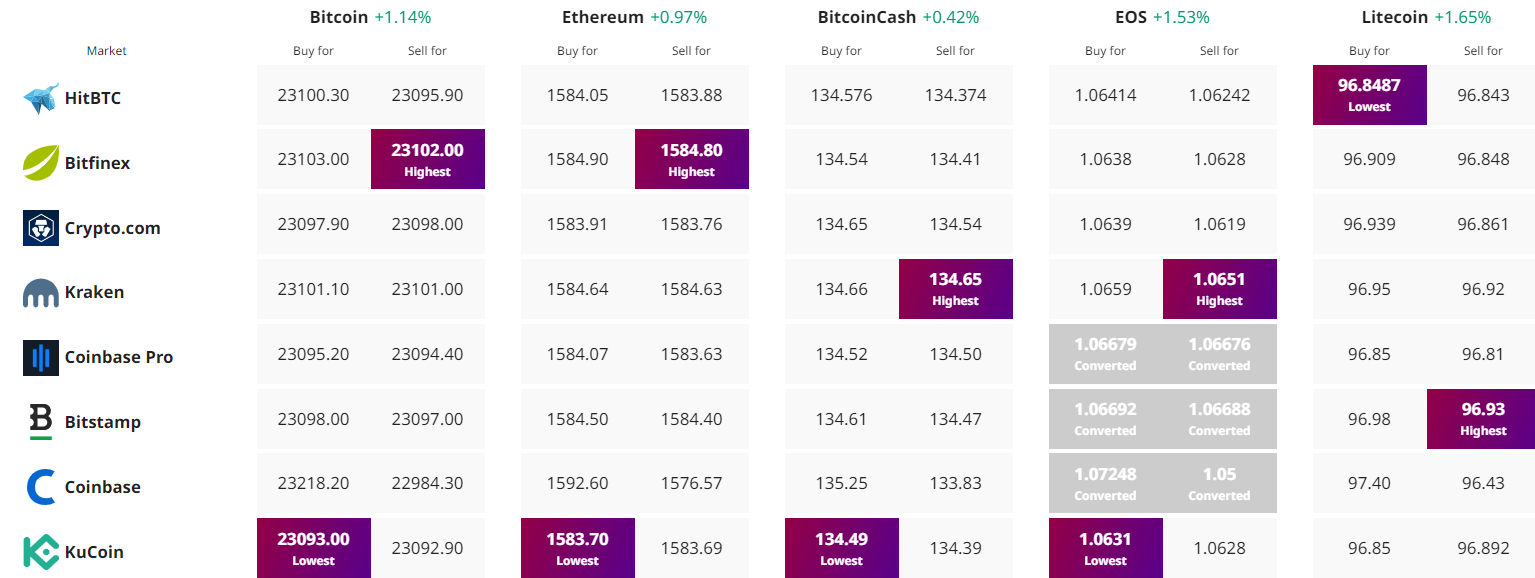

Find the best price to buy/sell cryptocurrency