Bitcoin And Ethereum Prices have been rising recently, with both BTC and ETH gaining 4% following the Federal Reserve’s rate hike. As more and more investors turn to cryptocurrencies as a safe haven asset, it is likely that the price of Bitcoin and Ethereum will continue to rise in the near future.

This article will provide an overview of current market conditions and discuss whether BTC and ETH prices are headed for further growth in light of recent events.

Cryptocurrency: What Is The Fundamental Outlook Today?

The world’s largest cryptocurrency bitcoin skyrocketed after the Federal Reserve raised interest rates by 25 basis points. Bitcoin has gained popularity due to various developments in the cryptocurrency sector, such as an increase in institutional investors and advances in crypto legislation.

On Thursday morning, Ethereum (ETH) crossed the $1,600 mark, which has generated optimism among the investment community. This positive sentiment has been bolstered by Jerome Powell’s recent comments regarding the decline in US inflation.

The global cryptocurrency market surged after the Federal Reserve announced an expected increase of 25 basis points to create a favorable environment for the crypto sector. On Wednesday, the Federal Reserve raised interest rates by 0.25%, signaling the need for further tightening of monetary policy. As part of its ongoing fight against inflation, the Fed promised “steady increases” in borrowing costs.

Therefore, the most recent decision from the Federal Reserve was seen as a good thing, boosting the cryptocurrency market and helping the rise of bitcoin. Meanwhile, the increasing number of institutional investors has contributed a lot to the market support for cryptocurrencies.

Across the ocean, progress in legislation surrounding cryptocurrencies was another important element that was seen to have a positive impact on the crypto industry.

Crypto Miners Struggle

As institutional interest in the bitcoin futures market grew, retail investors began to show interest in bitcoin. According to Glassnode, the number of addresses with more than 0.01 coins has increased over the past month. This was seen as another major factor boosting Bitcoin (BTC) prices.

In contrast, the miners weren’t having much fun. Last week, bitcoin miners’ earnings decreased significantly, and they were further adversely affected by rising electricity costs.

This could put further pressure on miners to sell their holdings, which could have a detrimental effect on the price of bitcoin.

US dollar declines after less hawkish FOMC meeting

The broad-based US dollar continued to slide after the Federal Reserve raised interest rates by 25 basis points, and promised “sustained increases” in borrowing costs as part of its ongoing fight against inflation.

Despite a healthy economic outlook, the Federal Reserve remains wary of inflation. To counter this, the US dollar has been weakening, which in turn has created an environment that has helped bitcoin prices soar.

bitcoin price

As of today, the market rate of Bitcoin $23,900 and has seen a 4% increase in its value in the last 24 hours. It also has an impressive trading volume of $29 billion and holds the highest ranking on CoinMarketCap with a market cap of $460 billion.

On the 4-hour time frame, bitcoin is trading with a bullish bias and there is an immediate resistance near the $24,250 level. If there is a bullish breakout of the $24,250 level, it has the potential to propel BTC towards the next resistance area of $24,800.

Moreover, if BTC price breaks above the $24,800 mark, it could move towards the $25,250 level. This is due to the less-than-hawkish Federal Open Market Committee and Federal Reserve rate hike decisions.

Major technical indicators such as RSI and MACD have entered the buy zone, and the 50-day simple moving average is also showing signs of a buy trend.

On the downside, bitcoin may find immediate support near $23,550; However, a bearish breakout of this level could create more room for selling below the $23,250 level.

ethereum price

Ethereum It has seen an increase of 5% in the last 24 hours, with its current price at $1,673. The 24-hour trading volume is estimated to be around $9.6 billion and according to Coinmarketcap, it currently ranks second with a live market cap of $204 billion.

On the technical front, Ethereum broke an ascending triangle pattern that was providing resistance near the $1,660 level. If there is a bullish breakout above this level, it could take ETH price higher towards $1,725 as an initial target.

On the four-hour time frame, the ETH/USD pair has formed a “three white soldiers” candlestick pattern, which is signaling a likely continuation of the bullish trend.

While the support remains near the $1,660 level, Ethereum could experience a bearish correction towards the $1,600 or $1,550 levels.

bitcoin options

Cryptonews Industry Talk evaluates the top 15 cryptocurrencies for 2023. If you are looking for a more promising investment opportunity, there are other options to consider.

The number of cryptocurrencies and new ICOs (Initial Coin Offerings) continues to grow on a weekly basis.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

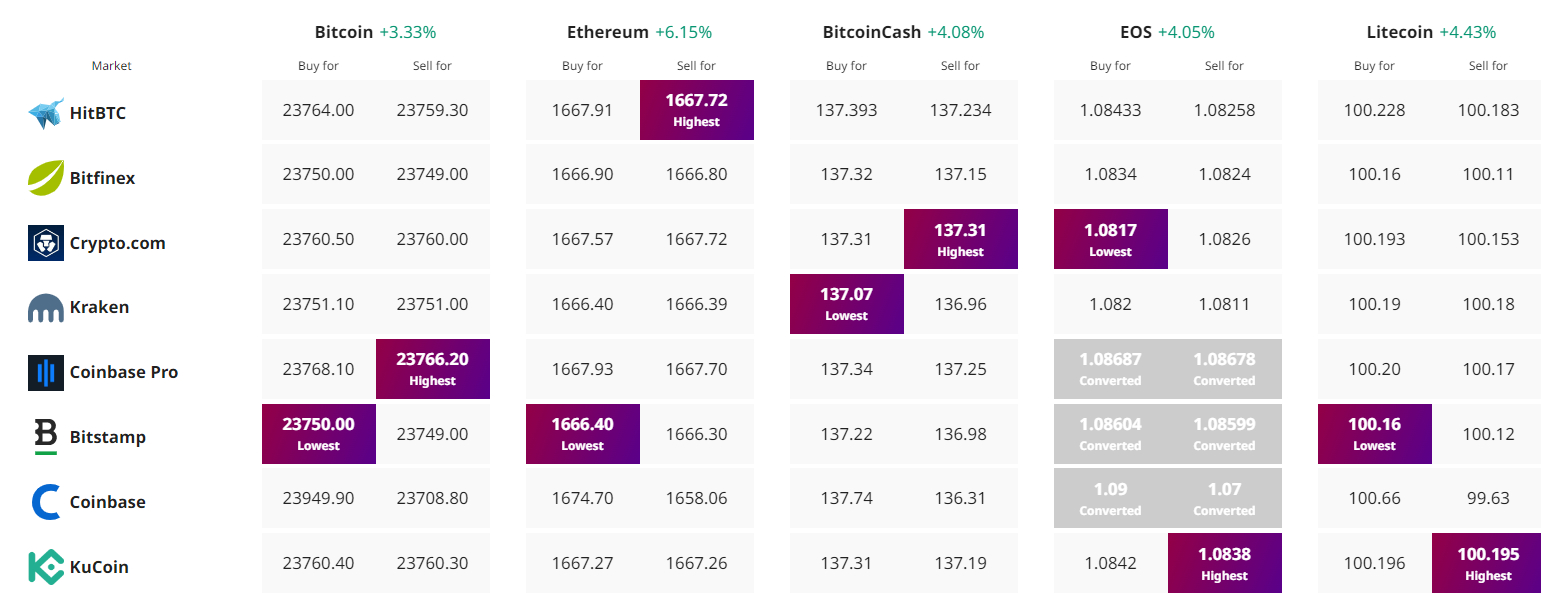

Find the best price to buy/sell cryptocurrency