Quick Take

- So far, 2023 has been a good year for Bitcoin and risk assets, with Bitcoin up 71%, Nvidia up 92%, and Meta up 68%.

- The S&P 500 is up 7% while the Nasdaq is up 20%

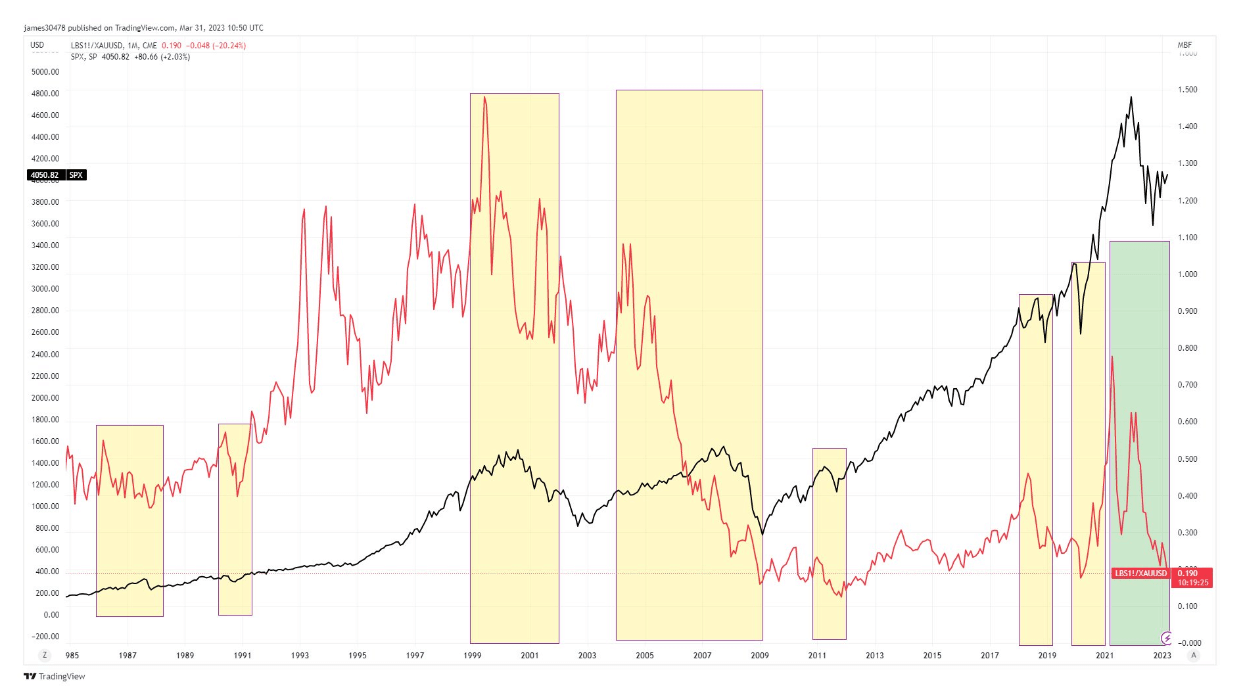

- However, the lumber-to-gold ratio indicates a risk-off environment, and the stock market has always followed a crash.

Highlighted are the areas where the lumber-to-gold ratio collapsed, and subsequently, the S&P 500 went down.

- 1987 Crash

- 1990 Bear Market

- 2000 Tech Bubble

- 2008 Lehman Crash

- 2011 Summer Crash

- 2018 4Q Correction

- 2020 Covid Crash

As Bitcoin is somewhat correlated to the US stock market this could mean further headwinds for Bitcoin.

The post Lumber to gold ratio breaks down, suggesting a risk-off environment appeared first on CryptoSlate.

prescription medication for severe allergies prescription strength allergy meds prescription medication for severe allergies